• GBP/AUD recovered some ground on Friday as absence macroeconomic catalysts helped the pair recover some ground.

• Next week will be pivotal as investors closely watch the CPI data from the United States and the UK, along with Britain's second-quarter gross domestic product (GDP) figures.

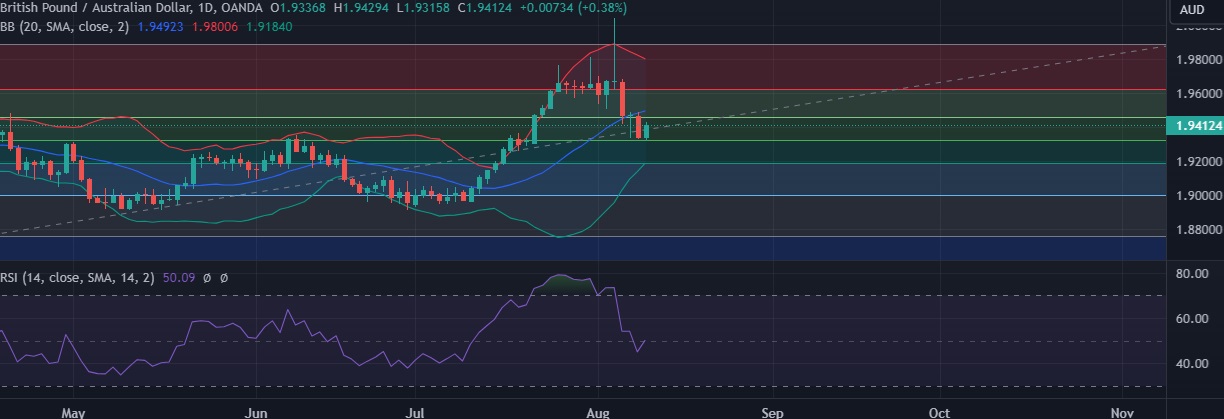

• A daily close above 1.9318 (50% fibonacci retracement) would reinforce the bearish outlook and potentially set the stage for a bigger drop toward the 1.9300 level.

• Immediate resistance is located at 1.9460 (38.2%fib ), any close above will push the pair towards 1.9622(23.6%fib).

• Strong support is seen at 1.9318 (50%fib) and break below could take the pair towards 1.9188(50% fib).

Recommendation: Good to sell around 1.9460, with stop loss of 1.9580 and target price of 1.9350.