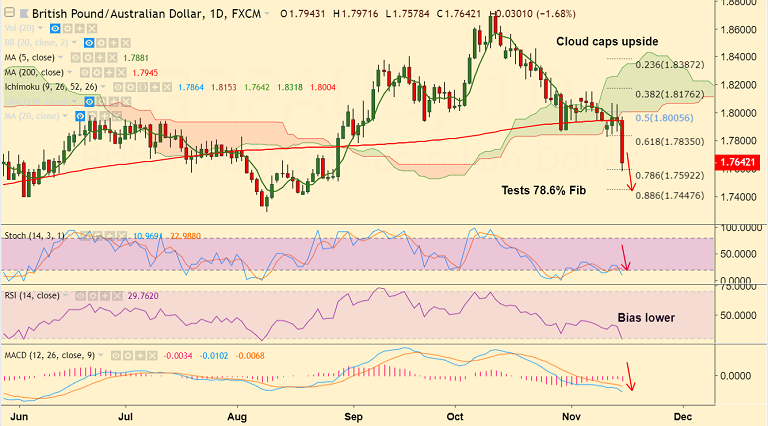

GBP/AUD chart on Trading View used for analysis

- GBP/AUD trades 1.63% lower on the day, tests 78.6% Fib at 1.7592, bias lower.

- Sharp sell off hitting the Sterling triggered by resignations in May’s Cabinet.

- Some members of PM May’s Cabinet resigned amidst a generalized opinion against the recently announced draft deal.

- UK Retail Sales came in below expectations for the month of October, further denting the pound.

- Data released earlier today showed UK retail sales contracted at a monthly 0.5% and expanding 2.2% YoY. Core sales dropped 0.4% m/m and rose at an annualized 2.7%.

- On the otherside, stellar Australia jobs data supports Aussie, weighing further on the pair.

- Momentum studies are bearish, pair is below cloud and major moving averages.

- Break below 78.6% Fib to see further weakness. Scope for test of 1.7282 (Aug 9 lows). Bearish invalidation only above 200-DMA.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025