• GBP/ AUD strengthened on Tuesday as sterling was boosted after a key measure of British wages rose at the joint fastest pace on record.

• UK basic pay was up at 7.3% versus 7.1% forecast, figures from the Office for National Statistics showed on Tuesday.

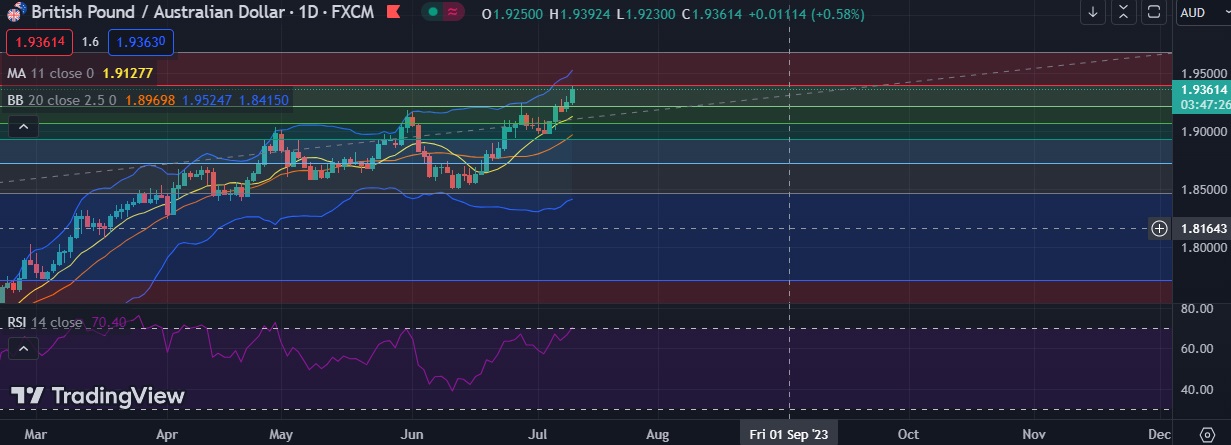

• A daily close above 23.6%fib will further improve the technical outlook, and open the possibility of a rally towards 1.9500 level.

•From a technical viewpoint, the moving averages are pointing upwards, while the RSI is bullish at 68.

• Immediate resistance is located at 1.9363 (23.6%fib), any close above will push the pair towards 1.9427 (Higher BB).

• Strong support is seen at 1.9214 (38.2%fib) and break below could take the pair towards 1.9127 (11DMA )

Recommendation: Good to buy around 1.9360 with stop loss of 1.9240 and target price of 1.9500