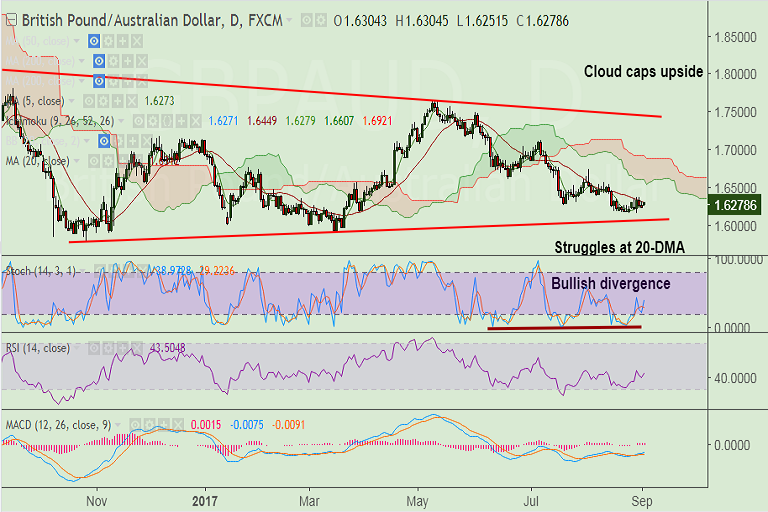

- GBP/AUD capped below 20-DMA at 1.6312, we see gains only on break above.

- Disappointing UK construction PMI print, which unexpectedly dropped to 51.1 in August keeps the pound dented.

- We see scope for upside on bullish Stochs divergence from price action.

- The pair is trading in a downward sloping channel, near-term bias bearish. We see bearish invalidation only on channel breakout.

- On the hourly charts, the pair is holding 200-SMA support, break below could see drag till 1.6075 (trendline).

Support levels - 1.6254 (1H 200-SMA), 1.6187 (78.6% Fib of 1.5789 to 1.76509 rally), 1.6075 (trendline)

Resistance levels - 1.63, 1.6312 (20-DMA), 1.6379 (Aug 31 high), 1.64,

Recommendation: Watch out for break above 20-DMA for upside.

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at 21.3353 (Neutral), while Hourly AUD Spot Index was at 49.9391 (Neutral) at 1040 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest