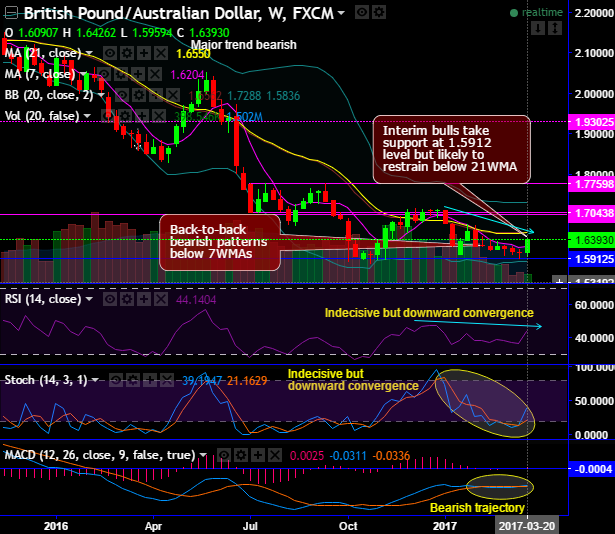

Although GBPAUD rallies have gone above 7WMAs on weekly plotting but remained well below 21WMA, for now, maximum upside potential is seen only upto stiff resistance of 1.6550 and 1.7049 levels.

As you could see on the monthly plotting, the recent attempts of upswings have been restrained and gone in non-directional from last six months, any failure swings below 7EMA likely to evidence slumps again; the current prices on this timeframe are hovering at around 23.6% Fibonacci retracement levels, hence, major trend has been bearish bias.

While both leading (RSI and stochastic) indicators are indecisive but no traces of bullish momentum at all.

The stochastic oscillator has been in halting oversold region since June 2016 and still been popping up with selling pressures on monthly plotting, the attempts of %K crossover are not convincing of bull swings that are prevalent while RSI is slightly in bears’ favor.

MACD is also in sync with this bearish indication, this lagging indicator evidences the bearish crossover and entering into the bearish trajectory that indicates major downtrend to prolong further amid minor hiccups of bull swings.

Hence, we advocate initiating shorts in futures contracts with mid-month expiries, well, having said that we wrap up with concluding note, short-term bulls can speculate this pair whereas long-term investors at current juncture contemplating above bearish indications, we advocate shorting futures contract to arrest the potential downside risks upto 1.6244, 1.6131 or even upto recent lows of 1.5905 levels cannot be ruled out upon breach of 1st two targets.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.