Although RBA kept cash rates unchanged at 1.5% in the recent meeting, monetary policy would remain expansionary over the long run; the more easing cycle is on cards. In other words, the Aussie central bank members can make the most of the summer break, rate hikes in Australia are not foreseeable for now which would imply that the more bearish pressures on AUD.

On the flip side, UK growth has been unchanged at 0.5% QoQ, while CPI is reduced to 0.9%, manufacturing PMIs suggest struggle in this segment, and manufacturing output substantiates this signal by giving the actual number at -0.9%, a considerable decline from previous 0.6%.

Consequently, in the prevailing bearish environment, you could observe that the momentary bulls of GBPAUD struggle to break and sustain above stiff resistance of 1.7080 levels (i.e.7EMA), currently trading in sideways at 1.6934 levels to signal more bearish pressures.

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

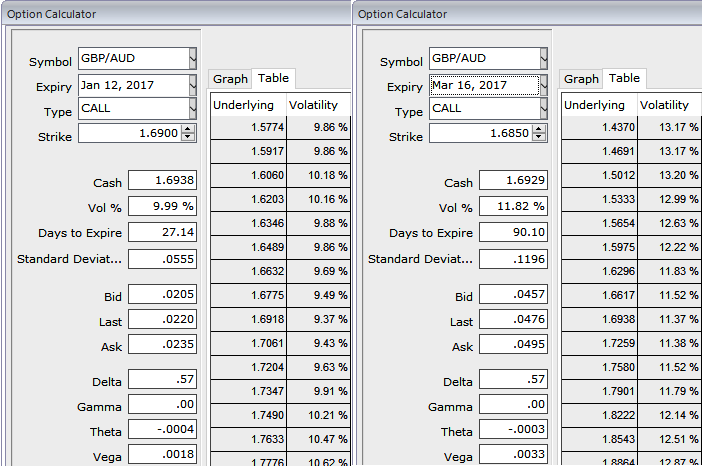

The execution: Initiate long in GBPAUD 3M at the money -0.49 delta put, long 3M at the money +0.52 delta call and simultaneously, Short 1m (1.5%) out of the money call with positive theta or closer to zero.

Rationale: The current implied volatility of GBPAUD 1m ATM contracts is just a tad below 10%, and it is likely to spike above 11.8% for 3m tenors as shown in the IV nutshell, rising IVs is conducive for option bidders. Option writers of expensive calls with 1m expiries would be on competitive advantage since IVs are on lower side.

Hecne we encourage vega longs in the above non-directional trending but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks