Please be informed that there has been a flurry of data streaks lined up to cause turbulence in GBPAUD OTC market.

The central bank of Australia is scheduled to be announcing its monetary policy on December 04th which is likely to stay pat, even if the RBA does not deliver easing in 1H’18, current account balance, retail sales trade balance, and GDP data announcement, in addition, would cause higher vols. While Brexit deal would still leave minimal carry support for sterling, whereas the Aussie dollar gets a cushion from commodity prices which is particularly important given its vulnerability to a turn in China’s momentum or adverse developments in global trade.

Consequently, in the prevailing puzzled environment you could observe that the momentary bulls of GBPAUD struggle to break and sustain above stiff resistance of 1.7802 levels, amid oscillation on either side, the current price is gaining some sort of upside traction. We advocate hedging strategy with the cost-effectiveness that could mitigate FX risks regardless of the swings on either side.

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

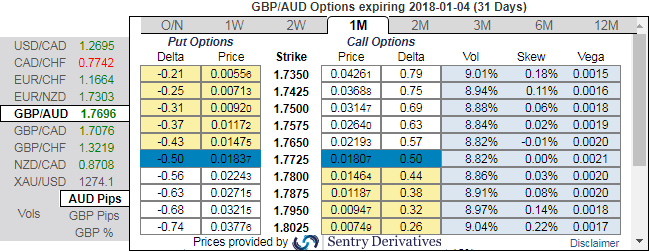

The execution: Initiate long in GBPAUD 3M at the money vega put, long 1M at the money vega call and simultaneously, Short theta in 2w (1.5%) out of the money put with positive theta or closer to zero. Theta is positive; time decay is bad for a buyer, but good for an option writer.

Rationale: Subsequent to the price action in last week, where sterling has been the clear outperformer, weekend actions likely to consent us at risk of retracing. While progress appears to have been made with regard to the negotiations of the UK’s ‘divorce payment’ to the EU, raising the prospect of ‘sufficient progress’ being made, the Irish border remains a difficult circle to square. In fact, Irish Prime Minister Leo Varadkar, who is against any form of the hard border, received the backing of EU Council President Donald Tusk, the latter stating that the EU is “fully behind” Ireland on the border issue. Today’s meeting between UK PM May and EU Commission President Jean-Claude Juncker will be watched carefully for developments – GBP faces volatility to headlines.

If Vega of a short (sell) option position is negative with an increasing IV is bad. Hence, we encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 18 levels (which is neutral). While hourly AUD spot index was at shy above 110 (bullish) while articulating (at 11:42 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different