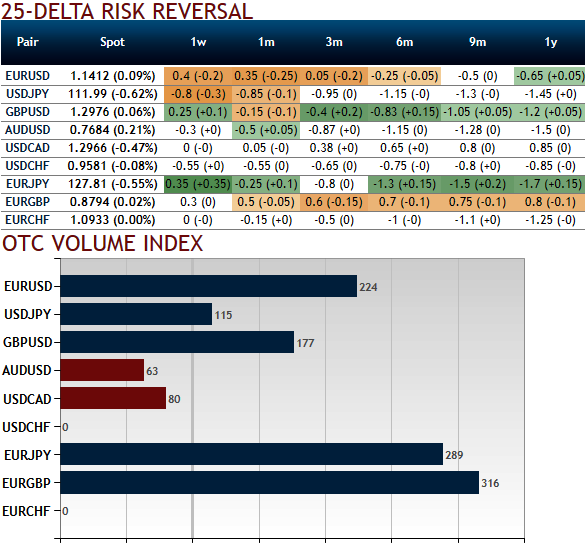

Please be noted that the above nutshell showing IVs and risk reversals of G10, has been indicating the mixed bag of hedging sentiments. Implied volatilities have been extremely lower and you could also make out that there has been no dramatic change in prevailing hedging sentiments (neutral risk reversals in 1w tenors and with neutral hedging sentiments in 1m-1y tenors for almost all pairs).

The OTC volume index shows volume traded in the past 24-hours versus a rolling one-month daily average. While not capturing all OTC flow, the index is a barometer of volume on liquid contracts for different crosses. Values over 100 indicate volume higher than the average, values under 100 indicate volume lower than the average.

Over the past week, G10 currencies strengthened against the USD but EM currencies softened. Incrementally hawkish rhetoric in Europe, Canada, and the UK helped the G10 complex.

However, over time there is a strong co-movement between G10 and EM currencies. Short-term deviations can occur but the trend is always the same.

It is possible that the link will break down if the Fed remains at a slow tightening pace and policy expectations in the rest of G10 are re-rated. But it is unlikely that EM will sell off meaningfully over the coming months/quarters if the USD is softening against g10.

Re-coupling will occur in our opinion, and it is more likely to happen via EM FX strengthening modestly and following the G10 rally.

There were some stirrings of life in FX options markets this week, helped by two developments that have potentially taken us one step closer to a pause in the never-ending stretch of vol declines since the beginning of the year.

On a forward basis, vol curves are almost flat –the average USD/G7 vol curve prices in only a measly 0.4 vols of recovery in 1M ATMs over the next two months from current bargain basement levels in the high-6s – reflecting a market priced for the onset of summer doldrums.

It would not be surprising to see risk management considerations spark a round of profit taking on carry /EM positions over the coming 1-2 weeks, and placid option pricing for the very short-expiries may not be consistent with the potential for reasonable realized volatility over this period.

FX vols enter H2 meaningfully cheap versus macro drivers, and should mean-revert moderately higher. A U- rather than a V-shaped rebound is consistent with past vol cycles and mixed carry trade positioning. Steep vol curves in G10 should flatten; consider +2M/-6M calendars as subsidized long gamma plays. EUR-cross vols and correlations should cool as data and price momentum rotates away from the Euro. Buy EURUSD vs EURPLN vol spreads and sell EURNOK – EURSEK correlations, consider medium-term [EURUSD↑, EUR/EM↓] dual digitals. USD correlations should rebound from multi-year lows as the dollar revives; sell back-end EURJPY vols outright or in spreads vs GBPJPY.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data