The Aussie dollar is likely to fortify in the near term as the market raises the likelihood of RBA tightening in the near term. Moreover, the resumption of the US dollar downtrend should provide an additional shot in the arm to the AUDUSD exchange rate. The gains, however, are expected to be modest.

It is likely that the USD recovery of the past weeks is largely due to the prospect of a far-reaching US tax reform. And indeed the tax reform might have a USD positive effect medium term. At the same time, it could also sow the seed of a renewed period of long-term weakness for the US currency, as US foreign debt might become an issue putting pressure on USD again over the coming years.

Elsewhere, the early infancy of Chinese economic development – with double-digit growth rates and a “new frontier” mood – is over. That means the country is facing new challenges. The high savings rates threaten to create forever new bubbles of overinvestment. This could be factored in both USD as well as AUD.

OTC outlook and options strategy:

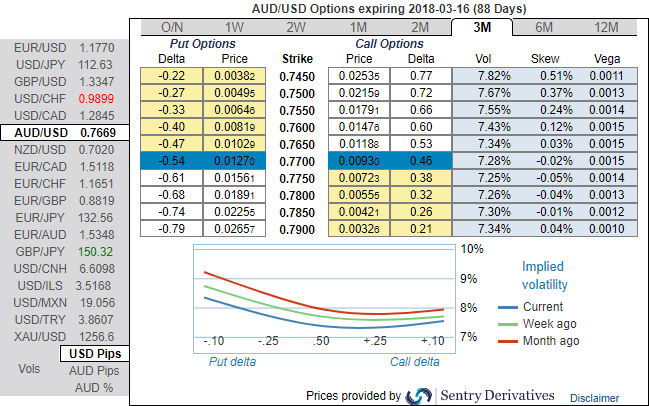

Please be noted that the positively skewed IVs of 1m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.7425 levels (refer above diagram). While bearish neutral delta risk reversal indicates that the hedging activities for the downside risks remain intact, and short-term technical trend indicates abrupt rallies in the days to come allow writing overpriced puts (refer technical chart).

Noticeably, ATM IVs of 2w expiries are just shy above 5.2%. Hence, the lower IVs are deemed as the right time to write overpriced OTM puts.

While using shrinking IVs of shorter tenors coupled with bearish neutral RRs could be interpreted as an opportunity for writing OTM puts or theta shorts in short run on time decay advantage as the spot FX market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Without disregarding the Fed’s rate hiking cycle in 2018, the bearish stance of the pair has been substantiated by bearish neutral risk reversals and positively skewed IVs of 3m tenors which is an opportunity for put longs in long-term as the US central most likely to raise the Funds rates by 25 bps.

Accordingly, we had advocated put ratio back spreads a couple of days ago, wherein short leg is functioning as the underlying spot FX keeps spiking.

Both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price dips and bidding theta shorts in short run and 1m risks reversals to optimally utilize Vega longs.

On hedging grounds, fresh Vega longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 2w (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spike mildly), simultaneously, go long in 2 lots of vega long in 2m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in short run and bearish risks in long run by vega longs.

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at 119 levels (which is bullish), while hourly USD spot index was at 5 (neutral) while articulating at 06:31 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays