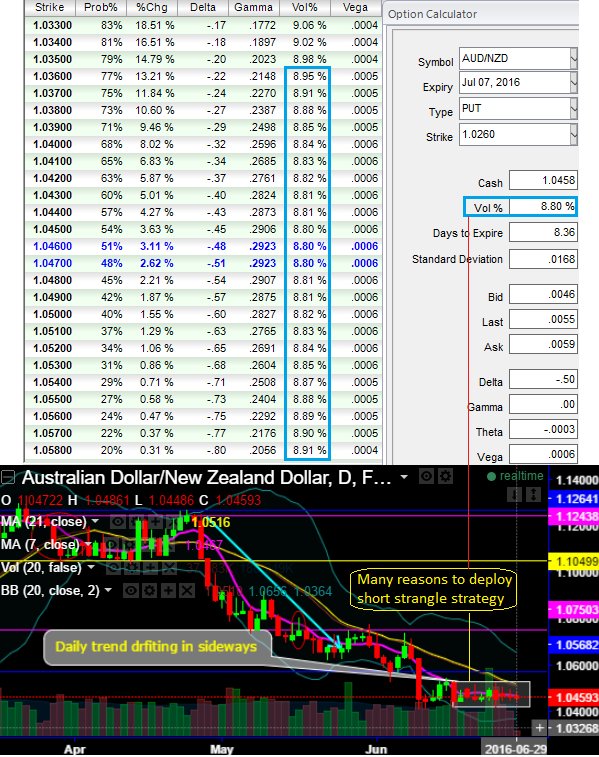

AUD/NZD IVs keeps option writers on upper hand. The implied volatilities of ATM contracts of all expiries have been the one of the least among G10 currency segment, 1W expiries flashes below 8.8%.

In AUDNZD FX options markets, it seems like huge disparity exists between option premiums and IVs as the 1W ATM puts have been priced 38% and calls are above 75% more than NPV whereas IVs as you can see for 1w expiries are just below 8.8% which in turn "a cause of concern as to whether spot FX would move in sync with IV and risk reversals indications or not".

While there is no significant news scheduled that could prop up pair on either direction except ANZ business confidence index.

Option-trade recommendation: Naked Strangle Sale

Technically, on daily charts AUDNZD’s range bound pattern is persisting but some bearish candles are indicating slight weakness, (Ranging between upper strikes 1.0534 and lower strikes at around 1.0408 levels) and we continue to see the same range as there is no indication from leading indications that could determine the direction of the next trend.

Well with that perspective on speculative grounds, as we could foresee range bounded trend to persist in near future but little weakness, strangle shorting is best suitable for above stated range.

We recommend shorting a strangle using out of the money options with 5% tolerance on either side, thereby, one can benefit from certain returns by shorting both calls and puts.

Naked Strangle Shorting

Overview: Sideways in the short term but Slightly bearish in the medium run.

Time-frame: 3 days to 1 week.

At current spot at 1.0448 with sideway trend keeping in consideration, we would like to remain in a safe zone by achieving certain returns capitalizing on tepid IVs.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed