The massive dollar uptrend is peaking with the massive repricing of yields triggered by the December Fed meeting. The FX space is now in consolidation mode, and the recent FOMC minutes were either neutral or slightly hawkish but delivered nothing that justifies lower real yields. All in all, USD directional positions are currently less appealing, and we look thus for opportunities in the crosses space, where EURJPY stands out with little bullish potential in short run.

But Euro area political and US policy risks will be the immediate drivers of the euro. In the Euro area, our base case continues to be that traditional parties will prevail (The euro in 2017: Populism precedes an ECB policy shift). Immediate focus will be on the Dutch general elections (March 15th) and polls for the French elections (April-May). Given the uncertainty around US policy, positioning for Euro area political risks is better expressed through short EUR/CHF rather than EUR/USD.

On the other hand, we expect foreign investors, who have sold JPY aggressively since the US election, to be possible buyer of JPY again, hence, expect strength in Yen. But the major headwind is that the BoJ’s meet on January 30-31. While we expect inaction of the BoJ until Kuroda’s term ends in April 2018, Outlook Report will garner attention at the upcoming meeting.

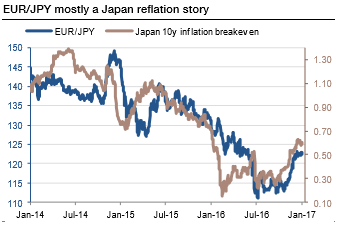

EURJPY has essentially traded as a function of the Japan reflation story (refer above graph) since the start of 2014. Interestingly, large EURJPY variations have been well anticipated by the gyrations in Japan 10y breakevens.

They bottomed at 0.2-0.3% in 2016 but have recovered to 0.6%. The BoJ certainly expects to continue to do its best to engineer a more ambitious repricing in inflation expectations (expect it to again use the quantitative toolkit).

As EURJPY trends are well explained by a Japanese factor, one may presume that they have been quite insulated from euro moves. But reflation has had a major impact on both EURUSD and USDJPY. This is not totally coincident, and the euro remains a factor.

While there is likely still euro downside to come, the pace is now likely to slow, as the market should remain reluctant to reinstate massive EURUSD shorts below 1.04 in a context of euro area inflation surprising on the upside this week.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields