In this write up, we’re emphasizing on the potential currency from the EMFX space where the global conditions remain largely supportive of yield-seeking behaviour. While monetary conditions remain accommodative in much of the developed world, and the Fed’s upcoming balance sheet reduction is well-anticipated by markets.

Yes, we meant long build ups in Turkish lira versus dollar and another currency from the emerging space that is ZAR.

Ahead of Turkey’s 2019 general election, policy makers are likely to continue prioritizing both economic performance and financial stability. Against the forwards to end-2017 and to mid-2018, we are most bullish on TRY among EM currencies, based on the country’s expectations-defying economic growth and a vigilant central bank. TRY is also highly undervalued by various long-term measures.

US disinflationary pressures remain persistent, with wage pressures notably subdued, while the economy continues to expand at a moderate pace. These Goldilocks conditions may continue to suppress expectations regarding aggressive Federal Reserve monetary policy tightening, and keep US Treasury yields anchored. In turn, these factors should weigh on USD while easing investor concerns about financing conditions in emerging markets like Turkey.

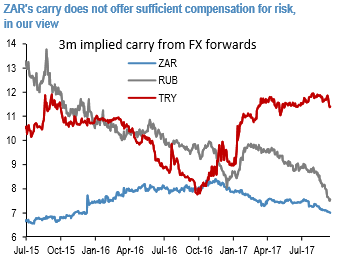

It is also recommended initiating longs in TRYZAR with a target of 4.20 and a stop loss of 3.60 (spot ref. 3.8175). Lira now offers about 11.5% 3-month nominal FX carry, highest among the liquid EM currencies. In contrast, ZAR’s 3-month FX implied yield has fallen to just 7% (refer above diagram), which is insufficient to compensate for the substantial political risks and uncertainty facing the country, in our view. We believe this discrepancy in the carry compensation for risk is excessive, and will result in a sharp repricing in the coming months. At this level of relative carry, total returns from a long TRYZAR strategy have been skewed very positively in the past.

The driving forces:

CBRT is in a credibility building mode and it is likely to keep yields high for an extended period of time. It is not expected that the central bank to ease policy until late Q1 2018.

A shift in the Turkish local population’s behaviour away from USD buying and towards TRY buying would catalyse strong gains in TRY.

Continued strong economic data from Turkey (e.g. GDP growth figures) and more diplomatic rhetoric from politicians would boost investor sentiment toward TRY.

Strong negative economic repercussions stemming from natural disasters such as Hurricane Harvey could further strengthen the case for very gradual normalization of US interest rates. Likewise, dwindling optimism regarding US fiscal stimulus materializing in the near future could also support EM currencies.

Risk profiling:

Flare-ups in geopolitical tensions (e.g. between the US and Russia / North Korea / China) could precipitate flight-to-safe haven behaviour that would undermine the recommended position. TRY remains a high-beta currency.

Negative idiosyncratic newsflow for Turkey (e.g. diplomatic fall-outs, terrorism, downbeat economic developments) would impair the trade’s profitability.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data