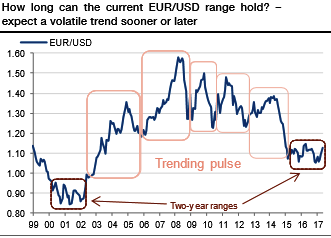

EURUSD has traded between about 1.05 and 1.16 since 2015. While these bounds are pretty wide, this has been the longest period deprived of trends since the introduction of the single currency (refer above graph).

EURUSD should move towards the top of its range in a choppy way, generating unusual topside volatility along the way.

At this stage, we think it is legitimate to anticipate that this lasting range-bound period is poised to morph into a more directional market. Indeed, we forecast an overshoot above the 1.16 upper bound by year-end, but we expect the decline of the dollar to be quite choppy. We think euro appreciation should generate more volatility.

Buy EURUSD 6m call strike 1.15, European KI on the realized volatility at 9% Indicative offer: 0.60% (vanilla: 1.61%, volatility swap: 7.6%, spot ref: 1.1226)

Trade risks: limited to premium, soft euro, and volatility. This exotic option is a standard 6m vanilla call strike 1.15, which will be activated only if the realized volatility is above 9% at the expiry. If the volatility terminates lower, the option will be worthless even if EURUSD trades above 1.15.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand