Sterling was able to retrace the losses it had accumulated during the course of yesterday almost in their entirety but was unable to appreciate significantly beyond that.

Please be noted that GBPUSD and EURGBP pairs flash implied volatility (IVs) numbers at 12.5% and 11.5% respectively, which are the highest among the G10 FX space (refer above nutshells).

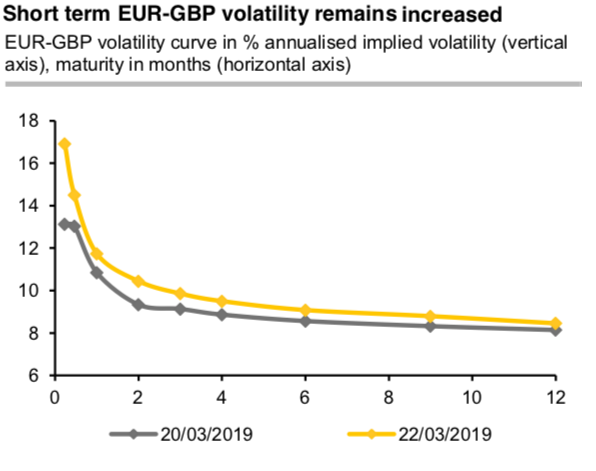

The IVs at the short end did not ease at all but instead rose further (refer 1st chart). That does not surprise as the market never believed in a no deal Brexit on 29th March in the first place otherwise the still relatively high GBP levels would be completely unjustifiable.

Instead, the FX market is now finally in a position to allocate a clear date to the Brexit risks, we will finally know where we stand within the next three weeks.

This realization had considerable effects on the options market: EURGBP risk reversals, which represent the cost differential between hedging against a weaker or stronger pound shot up significantly yesterday across all tenors (refer 2nd chart). That means the FX market clearly now sees a higher likelihood of Sterling collapsing, even if the spot rate is not yet reflecting an increased no deal risk.

Currency Strength Index: FxWirePro's hourly GBP spot index turns -21 (which is mildly bearish), while hourly EUR spot index was at -62 (bearish) at 13:05 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close