A likely by-product of the loss of USD momentum is a pause or even a modest reversal in USD-correlations that have surged this year due to across-the-board dollar weakness. We do not expect any de-correlation to be very pronounced given the primacy of US monetary and fiscal policy in driving FX movements in 1H’18 before other G3 central bank actions assume greater importance later in the year.

Hence ‘hard’ de-coupling option constructs –for instance, dual digitals or worst-of options with out-of-the-money strikes –are not high percentage trades in our view despite the attractive implied correlation levels they sell. Carefully constructed vanilla option triangles can be a viable alternative to exotic options as a mild USD correlation breakdown construct.

For instance, one could sell USD puts/JPY calls and USD calls/CAD puts (in equal USD notionals) but hedge out the resultant long CADJPY delta risk by simultaneously buying CAD puts/JPY calls of the appropriate strike (the equivalent cross-yen strike derived from the two USD leg strikes) and in appropriate notional amounts (equal to the yen notional of the USDJPY leg). Because they involve selling two options and buying one, these triplets entail earning premium at-inception; and because ‘closing the delta loops’ of the triangle leaves little or no directional exposure, to begin with, overt spot divergence is not a pre-requisite for retaining the upfront premium credit.

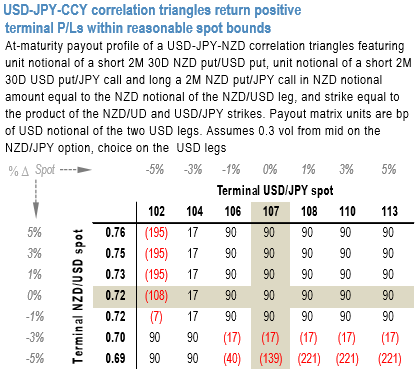

A scenario grid of spot levels at maturity helps visualize terminal payout outcomes; such an exercise for a USD-JPY-NZD triangle, for instance, shows that returns are positive in most states of world within (subjectively) sensible bounds of terminal spot, not only in the anti-correlated quadrants of the grid but also in significant portions of the rest of the table where traditional de-correlation structures fail (refer above nutshell). Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary