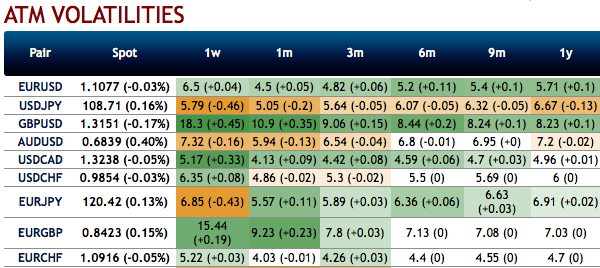

Amid low IV (implied volatility) environment, VXY Global heads into next year with the deepest cyclical undershoot on record, in excess of 3 % pts. The IVs of most of the FX pairs have been tepid, jerking in the range of 4-7% except cable and EURGBP.

The ultra-cheap vol valuations however need to be set in the context of less stressful global economic conditions next year. JPM baseline expectations of lukewarm moves from the big G3 FX, and the drip feed of USD strength in 2019 of the kind that erodes speculative interest in FX carry are other reasons to curb one's enthusiasm for a V-shaped vol rebound.

The path of least resistance to higher FX vol next year runs through politics (US/China, US elections), not economics.

Option themes for 2020:

1) The favoring EM vol over DM vol;

2) The betting on Euro strength through contained upside structures / RVs;

3) 2020 US elections: long USDCHF forward volatility over the Democratic primaries;

4) The systematic shorts in AUD and JPY risk- reversals as their risk-sensitivities have regime shifted lower;

5) Activate longs in GBPUSD 1Y1Y forward volatility for renewed back-ended Brexit disruption; and

6) The model-based mean-reversion pair selections (NOK vs. SEK, PLN vs. HUF). Courtesy: JPM & Saxobank

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge