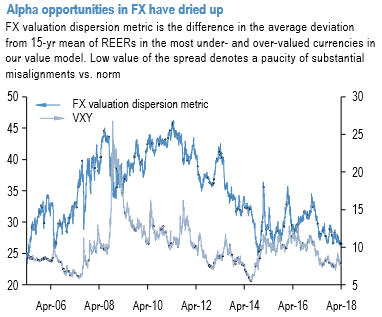

A deficiency of alpha opportunities overall within FX universe away from the broad dollar outlook is also being blamed for a lack of leveraged investor enthusiasm for options. There is some merit to this argument in that substantial currency misalignment that had provided fodder for major macro trades earlier in the decade have shrunk to multi-year lows (refer above chart).

While that fact is undisputable on its own, it is still unsatisfactory as an explanation for the vol softness in recent weeks since the process of diminution of value opportunities has been in train for months if not years and FX vol itself does not seem to bear much of a correlation to the metric.

In short, our sense is that, market participants are as perplexed about exhausted FX vols as we are and that most of what is passing for explanations are little more than post facto rationalizations of price action. Market strategy amid this uncertainty is respectful of the need for theta control in this climate via a mix of carry trades in good quality EUR/EM crosses where carry/vol ratios are elevated (EURRUB) and RVs designed to earn hedged vol carry (EURCAD vs EURRUB, short NZD vs. JPY correlation via vanilla triangles).

Defensive trades held in the form of cross-yen vs. USD-vol spreads (GBPJPY – USDJPY, BRLJPY – USDBRL) have held in well so far, but standalone long forward vol lookalikes in EURGBP and USDCLP are proving challenging. Portfolio changes this week involve taking profits on a long-held EURCNH carry position in light of the escalation in trade war rhetoric, and adding a short 2M EURGBP – EURAUD correlation swap.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed