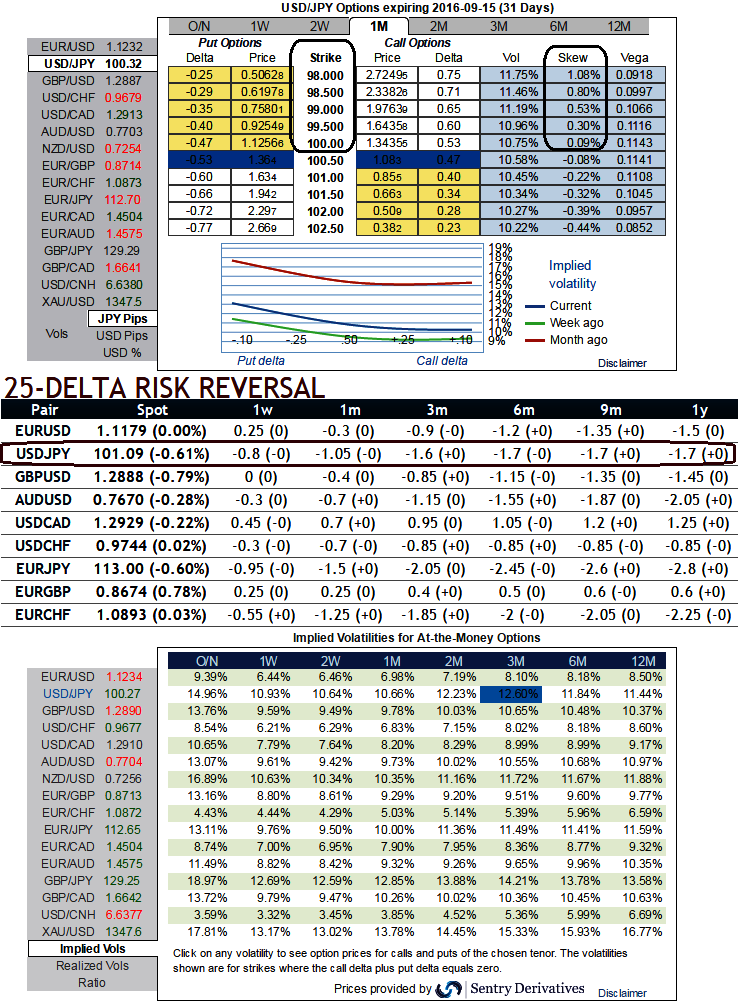

Let's have a glance on OTC market arrangements for hedging the uncertainty in this pair:

The delta risk reversal for USDJPY in long-term indicates more bearish pressures in FX option markets.

What we could infer from this indication is that hedging activities are mounting up downside risks as this is one of the top three pairs to have negative sentiments.

While IVs for next 3month contracts reasonably higher at around 12.60% but the same ATM contacts of 1-3 expiries have reasonable implied volatilities (10.75%) for both writers and holders that are likely evidence any change in its premiums provided underlying spot responds to the relative option instruments (see and compare current 1w & 1m contracts with 3m-1Y tenors).

Most importantly, delta risk reversal for the pair is still the highest negative values among entire G10 currency space for all expiries, so we believe any short upswings are the best advantage for bears and may be utilized for shorts in hedging strategies so as to reduce the hedging costs. (Compare delta risk reversal with last week).

Hence, we reckon USD/JPY upside to be limited in the short-term, as we think the risk to USD is skewed towards downside as well (1m ATM IVs are the live evidences for this). USDJPY either to remain range-bound into the next BoJ MPM or continue to slide further, while the short-term trend in USD would be affected by various factors, including UST yields, USD’s valuation and relevant developments in the US Presidential election.

Technically, the major downtrend still remains intact as the price declines in a sloping channel. Long Legged Doji while 7EMA crosses below 21EMA, price dips are in conformity to leading & lagging indicators and massive volumes.

Despite tight range between 102.436 on the north to 100.748 on the south, the pair manages to break supports at 100.531.

Hedging Strategy with FX options:

As per the fundamental, technical & OTC market indications, this would be deemed as good news for option holders contemplating the major bearish environment but more number of longs in ATM delta puts would ensure the reasonable probabilities in underlying exposures.

To factor in above mentioned the weakness in this pair as we could see reasonable IVs even in next 1-3m expiries, we recommend capitalizing more on bearish signals and the IV factor in the long term by employing OTM longs matching with ATM longs to construct back spreads that likely to fetch positive cash flows.

So, here goes the strategy this way, go long in 2 lots 2M ATM -0.50 delta puts, long in 3M (1%) OTM -0.35 delta put, and simultaneously short 2W (1%) ITM shorts, the spread is to be executed in the ratio of 3:1 with net delta at around -0.70.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand