Sterling has been the poorest performing among major currency space in the recent past as the market flipped the BoE from the vanguard to the rearguard of expected central bank policy normalization (the GBP NEER fell by nearly 3%).

The news flow was not universally negative –the government has moved to acknowledge the need for a lengthy Brexit transition that defers any economic adjustment for a number of years beyond the formal exit in 2019 – but weak cyclical developments are taking precedence.

In other words, the reality of a soft economy matters more for the near-term direction of the exchange rate than the expectation of a softer Brexit.

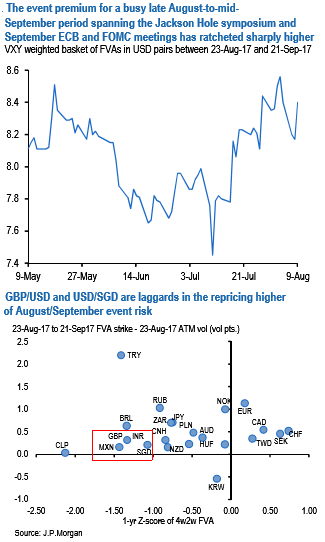

Event premium in the options market for the busy fall calendar has already ratcheted higher in recent weeks (refer above chart) and one straightforward play is to buy laggards in this repricing.

GBPUSD and USDSGD are two that fit the bill (refer above chart), with low nominal forward vols for the period covering the Jackson Hole symposium and the September ECB and Fed meetings (theoretical 23-Aug-17 to 21-Sep-17 FVA strike 7.5 for GBP, 5.0 for USDSGD) that are low by historical standards and price in only thin (< 0.5 vol) premium over pre-event dates.

Idiosyncratic vulnerabilities of the two currencies – GBP’s policy-related ones and SGD’s richness within the basket plus susceptibility to a Korea-driven regional deleveraging – are also supportive of vol ownership in these pairs. Source: JP Morgan

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data