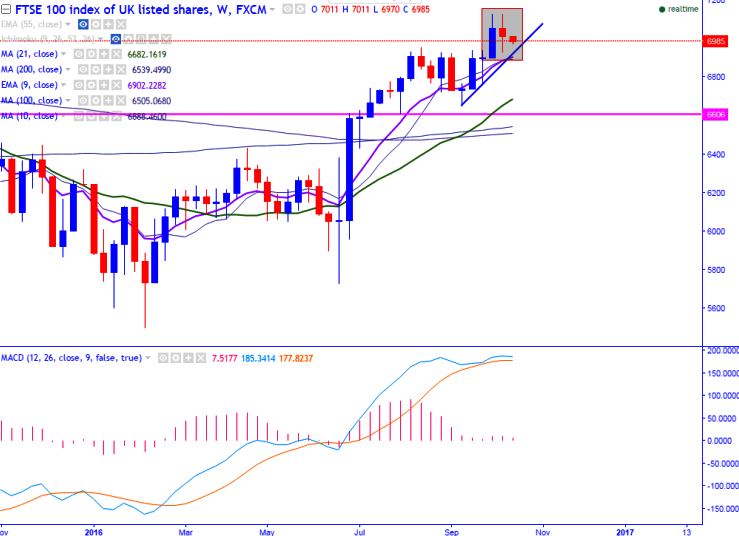

- Pattern Formed – Double Top

- FTSE100 retreated once again after jumping till 7129 in the previous week. It is currently trading around 6989.

- In the weekly chart, it has formed a double top around 7130 and any slight bullishness can be seen only above that level.

- Any break above 7130 will take the index to next level till 7223 (161.8% retracement of 7129 and 6928)/7300.

- On the lower side, any break below 6950 (21- day MA) will drag the index down till 6880 (9- W EMA)/6839 (61.8% retracement of 6646 and 7130).

It is good to sell on rallies around 7050-60 with SL around 7131 for the TP of 6950/6840