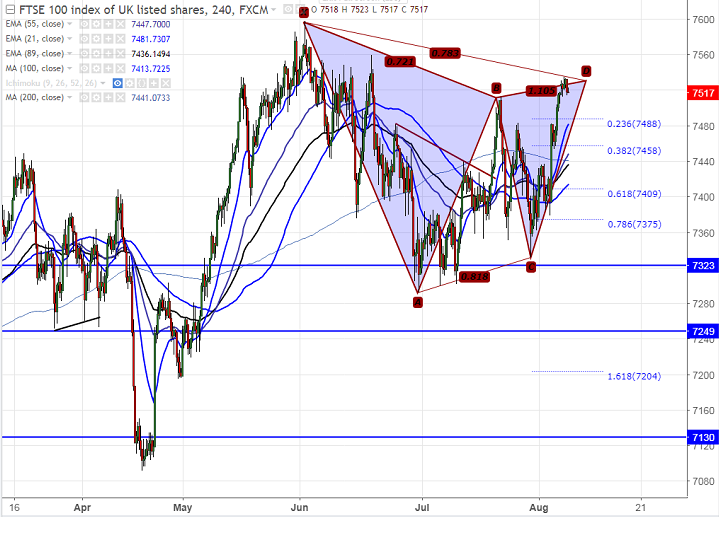

- Harmonic pattern formed- Bearish Anti Nen Star Pattern

- Potential reversal Zone (PRPZ) - 7597

- FTSE100 has formed a temporary top around 7535 and slightly declined from that level. The index declined till 7514 and is currently trading around 7516.

- The index has formed Bearish Anti Nen Star Pattern in the 4 hours chart and potential reversal zone is around 7597.

- On the higher side, near term resistance is around 7535 and any break above will take the index till 7597 (Jun2nd 107 high)/7629 (161.8% retracement of 7512 and 7332).

- The near term support is around 7510 (resistance turned into support) and any break below will drag the index down till 7485 (23.6% retracement of 7332 and 7535)/7440 (4H Kijun-Sen)/7412 (100- 4H MA).

It is good to sell on rallies around 7525-30 with SL around 7600 for the TP of 7415/7300.