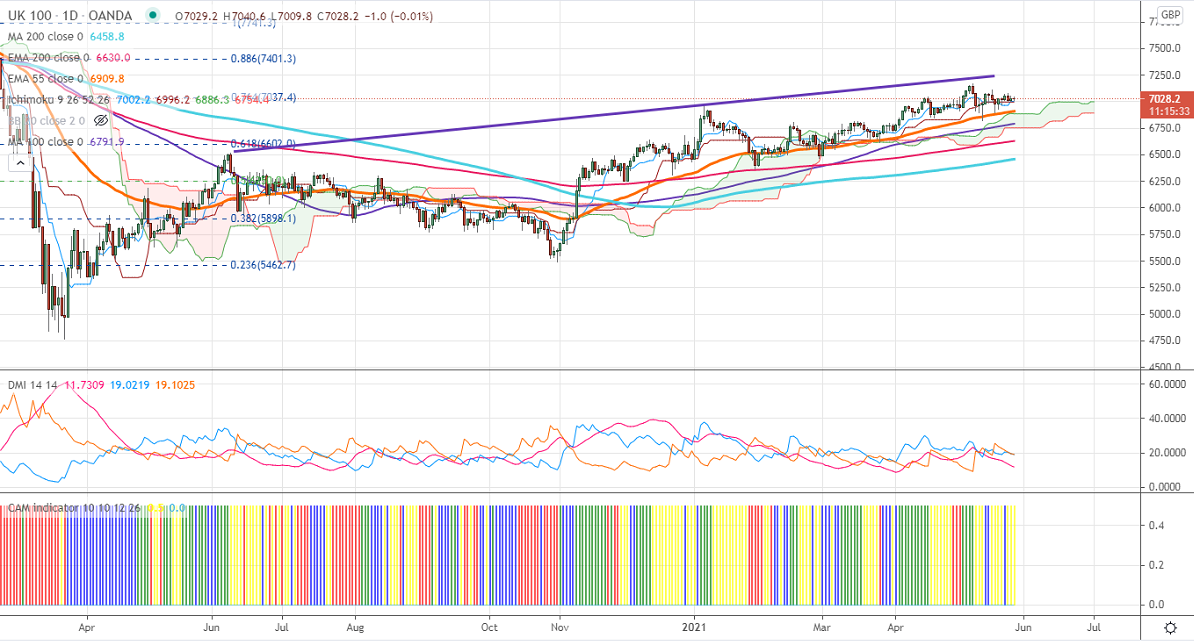

Ichimoku Analysis (Daily chart)

Tenken-Sen- 7002

Kijun-Sen-6995

FTSE100 is consolidating in a narrow range between 6896 and 7081 for the past five days. The European markets are trading near an all-time high after Fed keeps policy accommodative despite a surge in inflation. The FTSE100 jumped more than 13% in the past 3 months due to vaccine rollout and upbeat economic data. The UK government said that people should avoid travel to eight areas with a high number of Indian variants of Corona. FTSE100 should break above channel resistance 7265 for further bullishness. The FTSE100 hits an intraday high of 7040 and currently trading around 7024.20.

The near-term resistance to be watched is 7120 any break above will take the index till 7170/7220. Significant bullish trend continuation only if it crosses 7200. On the lower side, near-term support is around 7020, and any violation below targets 6985/6941/6900/6820.

Indicator (Daily chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to sell on rallies 7170-75 with SL around 7240 for the TP of 6820.