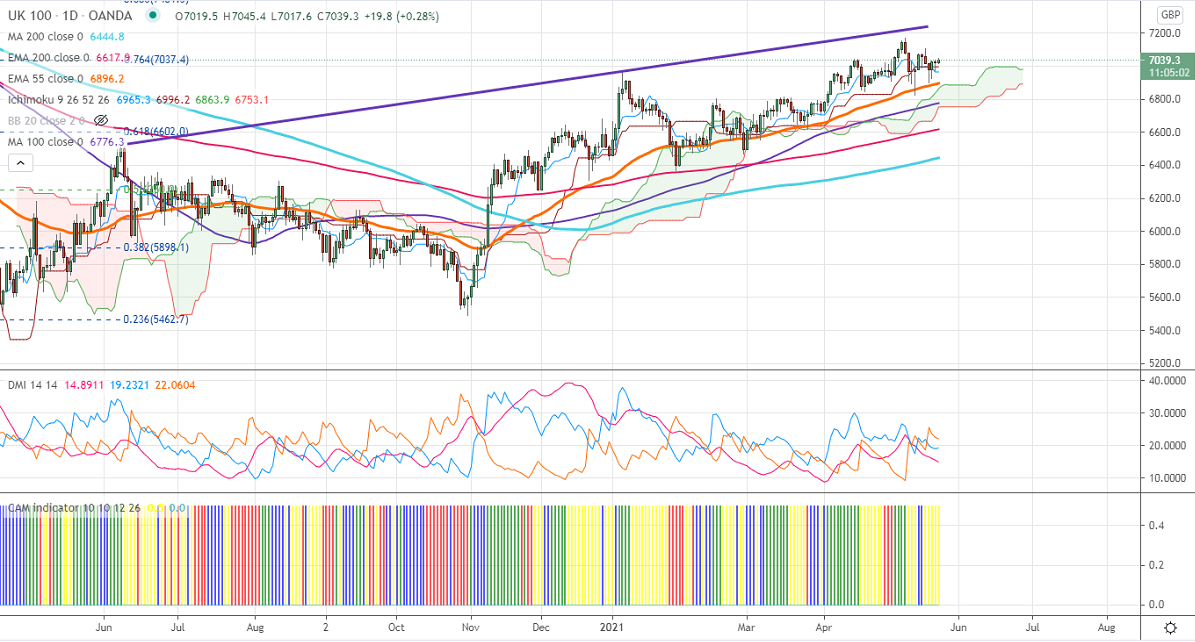

Ichimoku Analysis (Daily chart)

Tenken-Sen- 6965

Kijun-Sen-6996

FTSE100 is consolidating in a narrow range between 6896 and 7042 for the past three days. The decrease in coronavirus new cases and deaths in the United Kingdom is pushing FTSE100 higher. The UK Health Secretary said that he is "increasingly confident "that England is "on track" to exit the coronavirus lockdown. UK retail sales came at 9.2% m/m in Apr much better than the forecast of 4.5%. The yearly sales volume surged 42.5% higher than earlier. FTSE100 should break above channel resistance 7240 for further bullishness. The FTSE100 hits an intraday high of 7045 and currently trading around 7035.

The near-term resistance to be watched is 7120 any break above will take the index till 7170/7220. Significant bullish trend continuation only if it crosses 7200. On the lower side, near-term support is around 7020, and any violation below targets 6985/6941/6900/6820.

Indicator (Daily chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to sell on rallies 7170-75 with SL around 7240 for the TP of 6820.