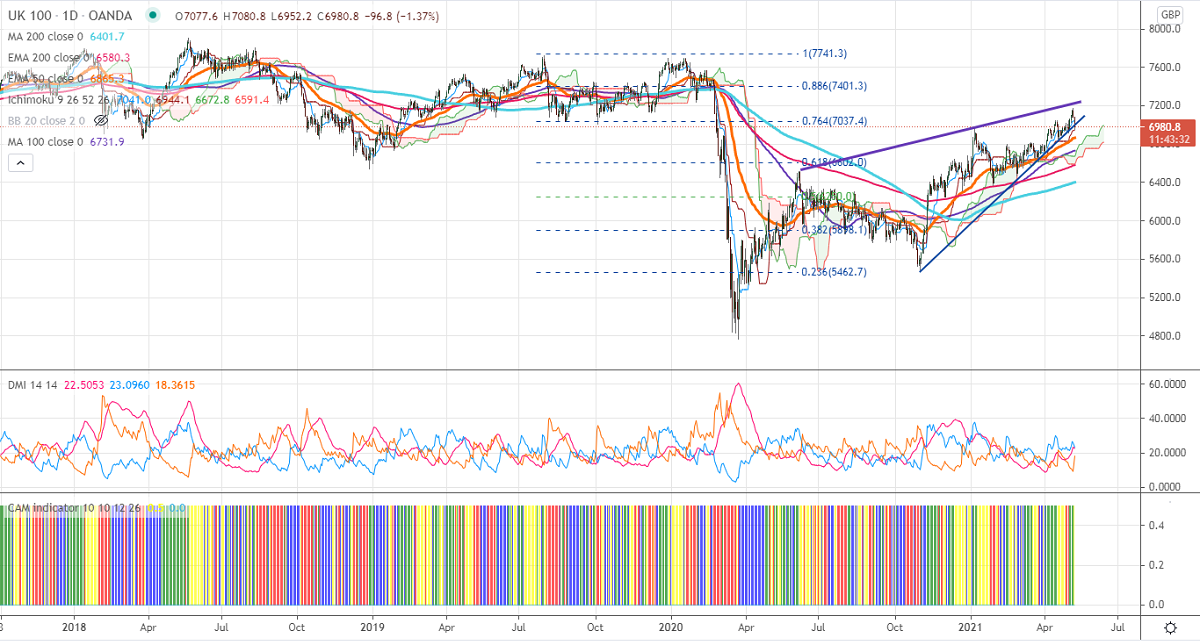

Ichimoku Analysis (Daily chart)

Tenken-Sen- 7041

Kijun-Sen-6941

FTSE100 continues to trade lower for second consecutive days and lost more than 200 points. The index surged above the pre-pandemic level on upbeat market sentiment and easing Covid restrictions. The strength in pound sterling is putting pressure on FTSE100. It should break above channel resistance 7220 for further bullishness. The FTSE100 hits a fresh pandemic high of 7169 and currently trading around 6981.

The near-term resistance to be watched is 7030 any break above will take the index till 7100/7200/7263/7300. Significant bullish trend continuation only if it crosses 7200. On the lower side, near-term support is around 6950, and any violation below targets 6900/6840/6800/6765.

Indicator (Daily chart)

CAM indicator – Neutral

Directional movement index – Neutral

It is good to sell on rallies around with SL around 6960 for the TP of 7200.