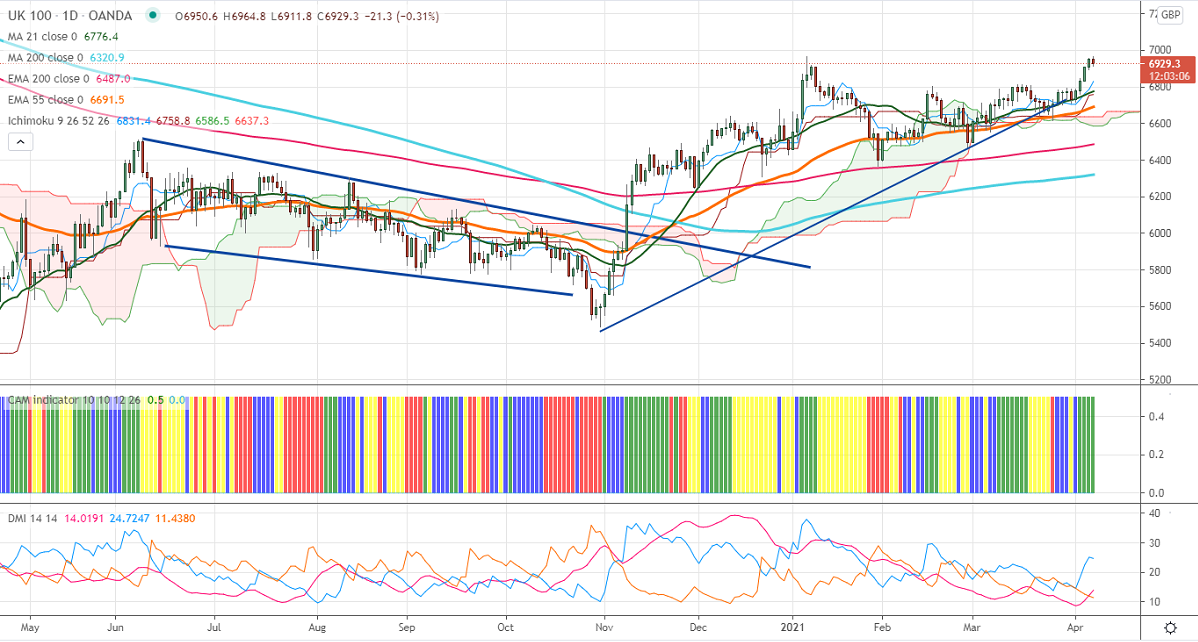

Ichimoku Analysis (Daily chart)

Tenken-Sen- 6786

Kijun-Sen-6754

FTSE100 has formed a double top around 6960 and shows a minor decline from that level. The global economic recovery and positive vaccine rollout in major countries are supporting the global markets. The U.S markets hit a fresh all-time high as US bond yields have fallen. The US 10-year yield lost more than 9% from a minor top 1.77%. The FTSE100 hits fresh pandemic high as more than 5 million people got second dose vaccination in the UK. FTSE100 hits an intraday high of 6964 and currently trading around 6928.90.

The near-term resistance to be watched is 6965 any break above will take the index till 7000/7040/7100. Significant bullish trend continuation only if it crosses 7000. On the lower side, near-term support is around 6880, and any violation below targets 6840/6800/6765.

Indicator (Daily chart)

CAM indicator – Bullish

Directional movement index – Bullish

It is good to sell on rallies around 6950-55 with SL around 7000 for the TP of 6800.