In this write-up, we emphasize on stochastic oscillator’s ability to trace signs of slowing or reversals in trend and find it to be efficient in timing entry into <2M expiry directional FX options trades.

We note that capped downside structures (call and put ATM/25D spreads) are efficient in cutting drawdowns (by more than 50%) and are worthwhile for EM currencies.

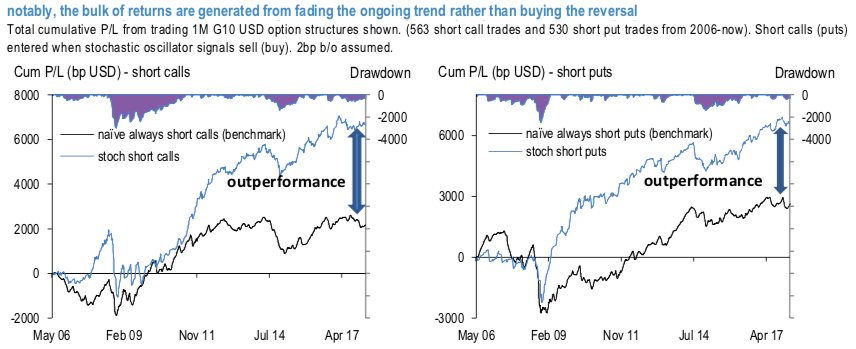

Shorting puts on bullish reversal signals and calls on bearish reversals chalks up 70% of overall P/Ls, seen from comparing 1stchart and 2ndchart cumulative returns. The fact that the bulk of returns are generated from fading the ongoing trends rather than buying reversals suggests that stochastic oscillator reversal triggers come a tad too early.

Capped downside (call and put ATM/25D spreads) cut drawdowns by more than 50%. The reduced premium intake of spreads is efficient in dampening drawdowns but comes at expense of reduced returns (2ndchart).

Nevertheless, the structures are worth considering in EM where capping downside risk when selling USD calls via spreads does not compromise returns but typically halves drawdowns.

Finally, stochastic oscillator is able to generate alpha in selling straddles but is worth considering only in G10 as it results in severe drawdowns in EM.

The Canadian dollar suffered a small set-back yesterday: even though growth rose in Q2 as expected, at an annualised +2.9% QoQ it nonetheless remained slightly behind analysts’ expectations. The fact that a notable rise in exports contributed significantly to the stronger growth turns the focus even more onto the agreement in the trade negotiations between the US and Canada aimed for today. This is an important moment for CAD. If an agreement can be reached, the path would have been cleared for the Bank of Canada to hike rates further, thus leading to a stronger CAD.

Most recently within G10 stochastic oscillator indicated:

1) Bullish reversal for USDCAD on Aug 2, AUDUSD and EURUSD, NZDUSD and GBPUSD — best expressed via long 1M risk reversals or short 1M ATM puts.

2) Bearish reversal for USDNOK, USDCAD, USDCHF, USDJPY and USDCHF —best expressed via short 1M risk reversals or short 1M ATM calls. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index has shown 38 (which is mildly bullish), while articulating at 13:29 GMT.

For more details on the index, please refer below weblink:

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?