The political risks are clouded in the euro area. The euro area economy has so far weathered political surprises in the form of the UK’s referendum vote to leave the EU and the election of Donald Trump as the next US President.

Euro-area political indecisions would now be prevalent over the coming year, with key elections taking place in –

The Netherlands (15 March),

France (first round of the presidential election on 23 April and second round, if necessary, on 7 May) and

Germany (by 22 October). Euro currency crosses and long volatility would offer the most attractive hedge for the scenario of a Le Pen Presidency with supportive government and Parliament. However, given the limited probability but large impact of the tail risk we recommend building exposure either via conditional structures or where the risk/reward appear asymmetric relative to our baseline scenario.

Latest polls advise that the far-right Freedom Party may win the most seats in the Netherlands, although without a majority.

In France, the far-right candidate Le Pen is expected by commentators to make it to, but not win, the second round. An unexpected victory for Le Pen would call into question the EU project.

In Germany, the Chancellor Merkel is expected a victory for the fourth term, although the right-wing AfD party is a key wildcard.

On long-term perspectives, the security and political risks should weigh on the EUR:

There also remains the prospect of further easing measures from the ECB (for example a formal extension of QE beyond March 2017).

OTC Outlook and Hedging Strategy:

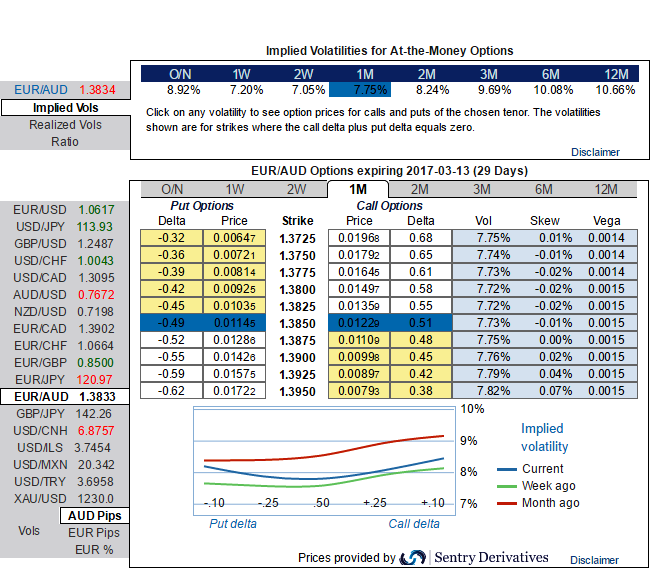

Please be noted that the positively skewed IVs in 1m tenors lures ITM put option writers’ opportunities. An option writer wants lower IV or IVs to shrink away so that the premium would also drop accordingly which could be the conducive case here if we have to evaluate OTC tools. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

Subsequently, 3m implied volatilities are considerably spiking on the higher side with positively skewed IVs towards OTM put strike that is most likely to favor vega puts in the robust downtrend.

As a result, we believe in jacking up in long leg of the below option strategy:

Initiate longs of 2 lots of 3m at the money vega put options, simultaneously, short 1 lot of (1%) in the money put of 2w expiry with positive theta. It is advisable to prefer European style options.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures