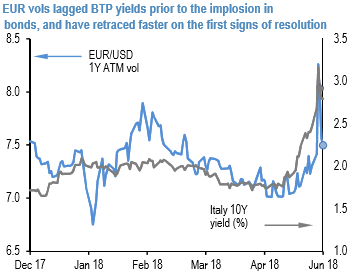

For a currency in the eye of a political storm, Euro spot and vols are ending the week on a surprisingly benign note, but their nearly unchanged week-on-week levels belie the intensity of the shockwave in Italian bonds that at one point threatened to re-open the wounds of the EU debt crisis.

Options are once again left looking too optimistic relative to the still palpable nervousness in bond yields (refer 1st chart) just as they were before the BTP shock, but investors have now been put on alert to the scale of the havoc that can result from more political turbulence in the days ahead.

Accordingly, long-end (1Y) risk-reversals, not just in EURUSD but also in EURCHF and EURJPY, reflect a reticence to signal the all-clear on Italian politics just yet, justifiably so in our view: unlike the enthusiastic reversal in ATM vols and short-dated skew.

Another corner of the EUR-complex that signals the possibility of additional jitters ahead is EURCHF options. EURCHF vols have been slower to normalize than other EUR-pairs even in short-expiries.

This is difficult to rationalize on realized vol grounds alone since high-frequency 1w delivered vols in EURCHF are running 2 vols softer than in EURUSD or EURJPY relative to where their respective 1M ATMs are priced.

One explanation for the apparent risk premium in EURCHF vol is that it is an artifact of reduced option market liquidity in the cross since the 2015 de-peg, which dissuades traders from liquidating EURCHF options at the first sign of normalization in the knowledge that re-purchasing may not be straightforward if need be.

Another more serious macro rationale could be the option market’s growing recognition that a regime shift in the EURCHF’s beta to the Euro is in the offing if the turbulent days of the EU debt crisis were to return; recall that EURCHF implied vols rose to as high as 1.8X of EUR vols at the peak of EMU tensions before the SNB installed the 1.20 peg. Whatever the reason, the evolution of the EURCHF – EURUSD vol relationship will be an interesting one to track so long as Italy and the revival of redenomination risk remains them for European FX. The swift late-week turnaround in options markets has reopened the door on European vol hedges that appeared to have been priced out due to the initial spike.

At 7.1 at the time of going to print, EURUSD 3M ATMs that form the trough of the vol curve and are 11.5 pts under trailing realizeds are as good a vol to buy as any. Along similar lines, 1M in 2M time (2M1M) EURUSD FVAs (6.9 mid, indic. 6.9/7.3) are also favorably priced along the forward vol curve (refer 2nd chart) and are useful management-lite vol longs for a resurgence of Italian noise.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data