On the verge of French and German manufacturing PMIs, today Euro's early market focus is likely to be on these 'flash' estimates of Eurozone PMIs for November.

The Euro zone aggregate preceded by French and German figures.

The data will provide a further read of activity trends in Q4 against a backdrop of comments from ECB officials on whether and what form of further policy easing may come at its meeting of 3 December. As a result, Euro has been experiencing higher volatility against G7 majors.

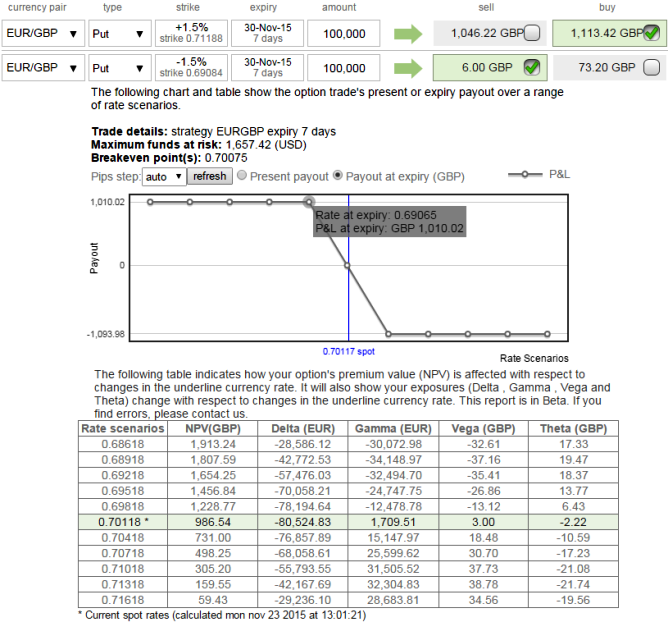

As you can observe from the diagrammatic representation, we've constructed put spread by considering gamma somewhere closer to zero that would neutralize the implied volatility impact on option price.

This position remains quite firm to achieve our hedging objectives (we've used price band between 0.7358 -0.6905), because we know gamma represents the change in delta, we still have healthier delta at -0.80.

This spread results in desired hedging objective irrespective of implied volatility disruptions as we have both ITM and OTM instruments on long and short side respectively and prevailing bear run will be taken by In-The-Money puts.

Gamma of ATM options near expiry increases, whereas the Gamma of ITM and OTM options decreases. The chart below shows the behavior of Gamma relative to time until expiry and the option's moneyness.

FxWirePro: Euro volatile ahead of EZ PMI data, deploying EUR/GBP gamma spreads reduce IV factor

Monday, November 23, 2015 7:42 AM UTC

Editor's Picks

- Market Data

Most Popular