Euro is struggling while German's ifo business climate dipped again 108.7 from previous 109.0 while forecasts were at 109.2.

This week's euro areas manufacturing PMI was an upbeat number at 53.1, service PMIs was disappointing at 53.9.

These are certainly restraining euro's growth in near future and act as hindrance for euro area as well.

On the contrary, GBP side we notice good set of retail sales numbers and CBI's industrial orders are expected to rise.

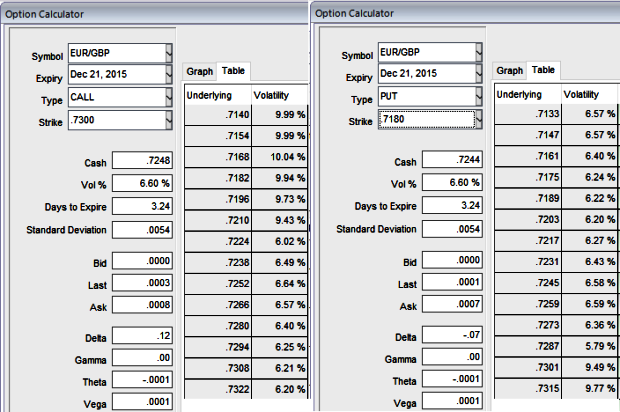

Option strategy: Covered strangles (EURGBP)

Let's visualize hypothetical scenario that we are holding EURGBP spot FX of 1000 units and expecting the underlying pair will never move anywhere beyond the range (0.7300-0.7185). Then short a 3D out of the money (2% strikes) while shorting 1w out of the money (3% strikes) for a net credit.

The appeal from the option strategy: Covered strangles are limited returns to the extent of premiums received initially, unlimited risk options strategies similar to the writing covered ATM calls.

Since the naked put write has a risk/reward profile of a covered call, a covered strangle can also be thought of as the equivalent of two covered calls.

Caution: The main risk of writing covered strangles is that you take on the downside risk of additional accumulation of gold to meet obligation.

FxWirePro: Euro seems weaker against GBP – hedge via covered strangles if notion states sideways

Friday, December 18, 2015 9:13 AM UTC

Editor's Picks

- Market Data

Most Popular