RBA maintains status quo to leave its cash rates unchanged at 1.50%, our outlook on the Aussie central bank is to remain on hold throughout 2018, and this is anchoring short-maturity interest rates and should keep 3y swap rates in a 1.80% to 2.30% range, as long as core inflation remains below 2%. Longer maturity rates will largely follow US rates.

Stay long EURAUD and EURNZD as de-synchronized central bank policy cycles, sensitivity to protectionism-inspired risk market stress and medium term valuations continue to underpin our constructive stance on EURAUD and EURNZD.

We would have preferred to see a more forceful de-coupling of the Euro from the commodity bloc as trade anxieties mounted this week, but were frustrated by the co-incidence of weaker-than-expected European PMIs. The downward inflection in the European data cycle, albeit at impressively high activity levels, bears close watching as a tactical risk to EUR longs.

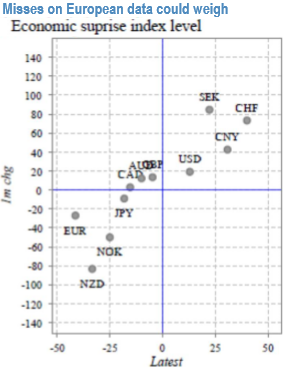

Negative data surprises (refer 1st chart) have forced our economists to lower their sights on 2Q’18 growth from 3% to 2.5% QoQ SAAR and pencil in a short taper in 4Q’18 instead of QE ending in September as earlier envisioned.

EUR now features as a sell within our rule-based economic momentum framework as a result of this forecast revision and some trimming of heavy spec longs in the near-term should not come as a surprise.

For EURAUD and EURNZD, the offset is that antipodean data and policy developments over the past two weeks did little to persuade us that shorts in these currencies require a re-think. In Australia, a weak labor market report re-highlighted risks to an over-leveraged household sector, and RBA minutes appeared to edge lower its views on potential growth in a continuation of the slightly dovish strain of commentary from the Bank in recent weeks.

In New Zealand, the 4Q real GDP print came in below consensus expectations and was explicitly noted in this week’s RBNZ statement.

Growth appears to have peaked for the cycle and is likely to fall short of the RBNZ’s +3% forecasts.

Policy rates in both countries, particularly Australia, have substantial room to fall to re-align with the serial disappointment in real activity in recent months (refer 2nd chart); our core thesis is that this should increasingly exert a greater influence on exchange rates as G3 central banks lift rates further and/or move closer to normalization.

A dovish leaning revision of Fed dots in the March SEP and European data misses may have delayed but not canceled the intensification of these rate pressures.

Buy EURAUD spot trades at 1.5880, stop at 1.5575. Marked at +0.47%.

Add longs in a 9m 1.80 EURNZD AED call with a 3m 1.80 window KO. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?