It is not exactly as if Italy had suddenly become reasonable on the fiscal policy front. With risk premiums in the area of 305 to 315bp (for 10-year government bonds versus Bunds) the bond market still sees an increased risk in the Italian government’s fiscal policy. However, what is relevant for the FX market is that this risk premium has not widened recently, but is moving sideways in the above range. That means the level constitutes a reasonable compensation for Italy’s fiscal risks – or so it would seem. As the Italian treasury will be able to manage these sorts of yield levels, there is currently no risk of a spiral of higher yields and growing fiscal risks developing. It is not sure whether that is fundamentally justified and in particular whether this properly reflects the political risks emanating from Italy.

On Friday, the euro recovery was majorly due to a USD effect, but there is a lot to suggest that the EUR weakness is coming to an end unless Rome produces new disturbing signals.

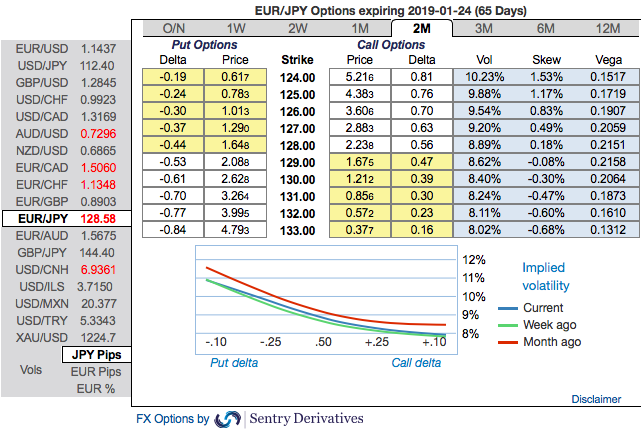

EURJPY IV skewness: Please be noted that the positively skewed implied volatility (IVs) of 2m tenors are signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 124 levels so that OTM instruments would expire in-the-money. The spot may trend around those strikes as the holders of the options will aggressively hedge the underlying delta.

Risk reversals: Most importantly, to substantiate the downside risk sentiments as stated above, bearish neutral risk reversal numbers of EURJPY across all tenors are also indicating bearish risks remain intact in the long run. While shrinking IVs that are on lower side, is interpreted as conducive for put option writers.

We have French and German data of manufacturing and service PMI numbers this week. Eurozone manufacturing PMIs are forecasted to be unchanged, while service PMIs are likely to show a minor dip, (manufacturing PMIs: consensus – 52.0, previous – 52.0; service PMIs: consensus – 53.6, previous – 53.7). These are leading indicators of economic health - businesses reactions to the prevailing market circumstances.

Options Trade Tips (EURJPY): Contemplating all the above aspects, we advocate buying 2m EURJPY ATM -0.49 delta puts for aggressive bears on the hedging grounds. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Source: sentrix, saxobank

Currency Strength Index:FxWirePro's hourly EUR spot index is flashing at -46 levels (which is bearish), hourly JPY spot index was at 154 (bullish) while articulating at (09:55 GMT). For more details on the index, please refer below weblink:

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different