The euro risks are increased as the ECB's governing council's monetary policy meeting scheduled on 10/03 in Frankfurt. Draghi recently says, euro zone growth and inflation prospects have weakened, the ECB to address and tackle them in March policy decisions.

Euro zone inflation dipped in negative territory in February, as a result ECB may unveil fresh easing package.

Elsewhere, for the countries neighbouring the euro area, conducting an independent monetary policy has become more difficult since the onset of the financial crisis in 2008.

This is particularly true of small open economies with both strong trade links to the euro area and currencies prone to increased pressure in times of crisis, for example Switzerland, the Czech Republic, Denmark and Sweden.

The Swiss economy has weakened notably over the past year. But at least it still recorded a rise of almost 1% at the end of the year which is no doubt a respectable result considering the discontinuation of the minimum exchange rate in early 2015. Following the appreciation shock there had been fears that the economy would slide into a deep recession.

However, anyone thinking that the Swiss National Bank (SNB) could now breathe a sigh of relief is wrong. Its task is to safeguard price stability. With an inflation rate of recently -1.3% it is a long way off this target at the moment. In view of such a notable fall in consumer prices one should assume that amongst all the G10 central banks it is the one most interested in a weaker currency.

Only that the reverse is happening: following a brief period of weakness the franc has been appreciating against the euro again since early last month.

The SNB does not seem likely to cut rates further in an attempt to push EUR/CHF higher, rather it may use its remaining policy tools (further cuts and/or actual intervention) to prevent EUR/CHF from trading much lower. Expectations for the SNB also unwound after the ECB disappointment so when the unchanged decision came on December 10, it was much as expected.

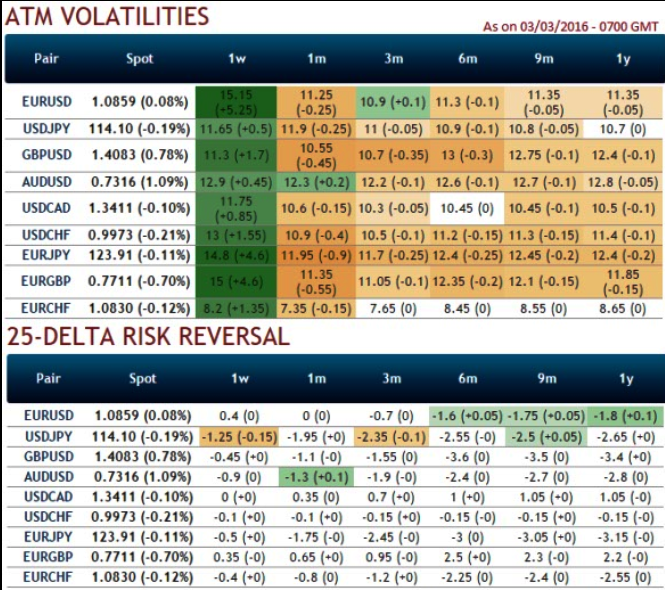

Delta risk reversals of EURCHF: From the nutshell, we understand that 25-delta risk of reversal of EURCHF has been one of the most expensive pairs to be hedged for downside risks as it indicates puts have been relatively costlier. As it showed the 3rd highest negative values which indicate downside risks of spot FX is anticipated and hedging for such risks is relatively more expensive.

The pace of appreciation in EUR/CHF remains painfully slow but we do not expect that to change. We have positioned EUR/CHF for sideways but slightly weaker in options with a risk reversal but the tenor (6M at entry, expiring August 2016) shows how long we expect this process to take.

FxWirePro: Euro bears line-up ahead of ECB meeting, Does SNB show sigh of relief? - buy EUR/CHF risk reversals

Thursday, March 3, 2016 1:19 PM UTC

Editor's Picks

- Market Data

Most Popular

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons