The European equities are recording the best earnings data since 2010. The Eurozone benefits from better valuations, improving macro data, fading political risk, slowly normalizing inflation expectations and still-accommodative central bank policy.

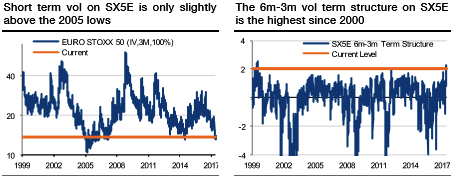

This is reflected in the volatility landscape. The entire VStoxx curve is within 0-5 percentiles of the historical data (since 2010) as shown in the chart below. The short-term volatility on the SX5E is now very close to the lows seen in 2005 when the Citi Economic Surprise Index for Europe was at similar levels as now. Finally, we note that as a result of the difference in sentiment between the short-term complacency around the French parliamentary elections and the medium-term caution around the Italian elections, the 3m-6m term structure has reached its highest level in the past 10 years.

We have, in our recent publications, focused on the bucketing effect in a low vol environment, and this concept has proven very close to actual market behavior. In short, we theorized that in order to cope with increased uncertainty, investors were increasingly focusing on hedging very specific events while choosing to profit by selling risk premium during other periods, leading to a lot of undulations in vol term structure. We expected this phenomenon to amplify as policy uncertainty waned and the economic environment improved, thus making the contrast between normal vol and vol around events even more pronounced.

Well, in a nutshell, relatively better valuations, improving macro data, fading political risk, slowly normalizing inflation expectations and still-accommodative central bank policy have all contributed to lower vol in European equities. Consequently, we recommend buying upside through options

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch