Euro area manufacturing PMIs produce upbeat numbers, actual 53.7 versus forecasts 53.2 and previous 53.5.

Euro area service PMIs also produce upbeat numbers, actual 54.1 versus forecasts at 53.1 and previous 52.8.

Flash Germany services PMI activity index at 55.0 (54.2 in October) 6-month highs.

Flash Germany manufacturing PMI prints at 54.4 (55.0 in October) 2-month lows.

Flash France services activity index increases to 52.6 (51.4 in October), 2-month highs

Flash France manufacturing output index(3) falls to 50.9 (52.5 in October), 2-month lows

Flash France manufacturing PMI(4) falls to 51.5 (51.8 in October), 2-month lows.

OTC outlook:

As a result of above economic indicators the OTC functions for Euro crosses are intensified.

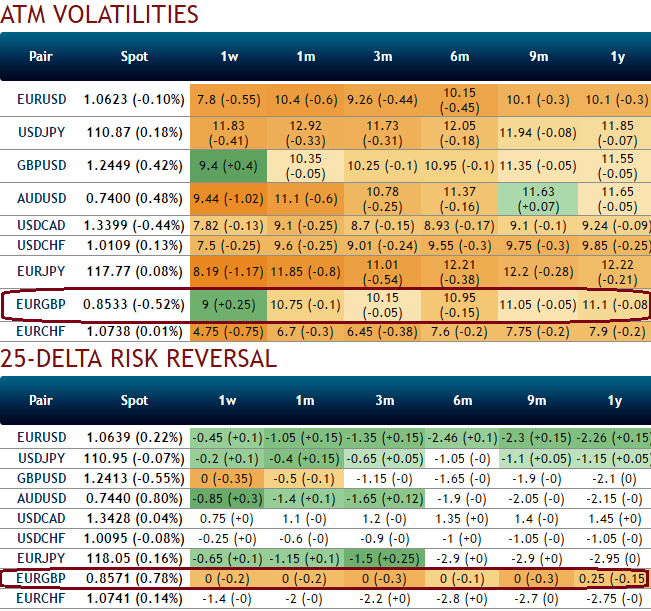

The implied volatilities of ATM contracts for 1w expiries of EURGBP are trending higher at around 9% which is a decent IV among G10 FX space.

While delta risk reversals flashing up progressively with negative numbers but neutral effects in overall OTC positions that signify hedging function changing its sentiments for downside risks over the period of time.

While current IVs of ATM contracts are at higher levels but likely to perceive hover around at an average 9% in long run that would divulge pair’s gain contemplating risk reversal arrangements.

Hence, considering above OTC market reasoning and fundamental factors we think upside risks are on the cards, as result we reckon deploying ATM instruments in hedging strategies are worthwhile.

Currency fluctuations:

While the short-term trend is still very much down and expected at this stage to gradually work its way down to the 0.84-0.83 region (summer lows and key weekly trend support), near-term studies are more constructive. As such we see the risk of a move back to the 0.8655/60 region, with a break there suggesting a broader correction back towards 0.8765/75.

Long term, we are suspicious that another move to retest the 0.97-98 highs set back in 2008 can’t be ruled out. A move through medium-term support in the 0.8350-0.8300 region would force us to review this outlook.

Hedging Strategy:

To factor in the weakness in this pair as we could see reasonable IVs even in next 1-3m expiries, we recommend capitalizing more on bearish signals and the IV factor in the long term by employing OTM longs matching with ATM longs to construct back spreads that likely to fetch positive cash flows.

Thus, we recommend initiating longs in 2 lots 1M ATM -0.50 delta puts, long in 2M (1%) OTM -0.35 delta put, and simultaneously short 2W (1%) ITM shorts, the spread is to be executed in the ratio of 2:1 with net delta at around -0.70.

Please be noted that the tenors and strikes shown in the diagram are just for the demonstration purpose only, use accurate inputs as stated above.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures