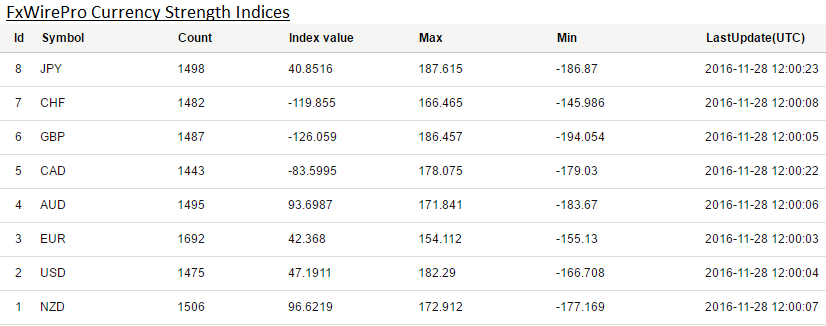

The US dollar index which measures the greenback’s strength against a trade-weighted basket of six major currencies was up about 0.08% at 101.56, while the FxWirePro Dollar Spot Index strengthened at 47 levels to signal mild bullish signals for intraday traders.

Equity flows in long/short hedge funds did better in the recent past, returning 1.7% since the election, most likely benefitting from the sectoral shifts towards Banks and Cyclical stocks. Their effective equity beta to the S&P500 index since the US election has been around 0.5 which is at the upper end of its historical range, suggesting that Equity Long/Short hedge funds have been rather successful in capturing the Trump trade post the US election.

Similarly currency hedge funds did even better returning 2.4% since the election, implying an unusually high 0.8 beta to the US dollar index. This suggests that among the various types of investors examined above, Currency hedge funds have been the most successful in capturing the Trump trade post the US election.

Outside Currency and Equity Long/Short hedge funds, the overall disappointing performance of hedge funds was not only the result of them (e.g. Risk Parity funds and Discretionary Macro) not having the right exposures into the US election, but also of their failure to embrace the Trump trade after the election e.g. their failure to increase their equity or dollar betas after the election or to decrease their bond betas.

This is consistent with the changes in spec positions seen after the US election. The above diagram shows the change in net speculative positions between Nov 8th and Nov 15th for US equities, US rates ex Eurodollar contracts, the dollar and three EM currencies.

This figure shows either a small change or a change towards fading rather than embracing the Trump trade (i.e. a reduction in the short position on US rates and a reduction in the long position on US equities). Again, this is another manifestation of the reluctance by investors to jump into the Trump trade after the election.

For now, more Brexit-related weakness and Fed hikes and estimates to attract shorts in GBPUSD during December and early 2017.

Short term volatility is likely to benefit the USD - Diverging monetary policy indicates a stronger USD further. We could foresee Fed hike certainly in this Christmas and three hikes in 2017. Whereas, the ECB is likely to cut the deposit rate to -0.6% and increase its asset purchases. - Despite the anemic recovery in the EMU, the risk of an unfavorable outcome will gradually be reduced. This and EMU current account surplus would support the euro a little.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge