Technical glance:

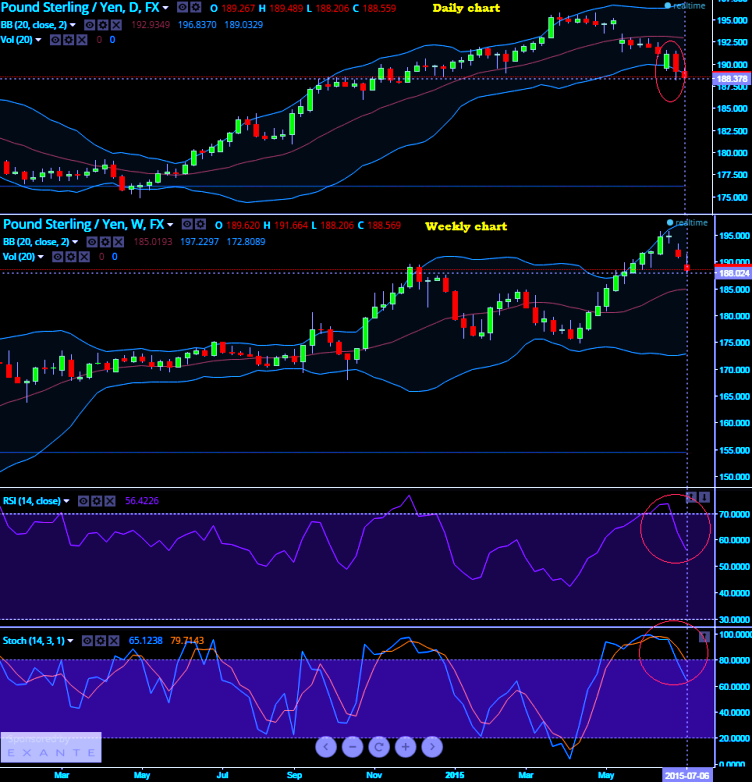

On daily chart of this pair shows bearish engulfing bearish like candlestick pattern occurred which means an earlier trend reversal is continue to hold.

But before jumping into the guns please note that this is for short term basis as the previous intermediate trend has been uptrend.

Engulfing bear is traced out on daily charts at around 189.258 levels which is a signal of weakness.

On weekly data, this is confirmed by oscillators with downward convergence to the price line.

RSI (14): 56.4115, converging with falling prices.

Stochastic: %D line 79.7331; %K line 65.2611 crossover above 80 levels signaling a clear overbought scene.

Currency Option basket: Bear Put Spread (GBP/JPY)

Bear Put Spread shall be used over Protective Put when the premiums on naked puts prove too costlier.

Bear Put Spread = ATM Protective Put (188.573) + Sell another Put with lower Strike Price (Out of the Money = 187.575) for GBP 100,000

It comes with a partial hedging option which only minimizes the loss if the underlying currency has to move lower but does not cap the loss.

Bear Put Spread reduces the cost of hedge by the premium collected on the Out of the money Put but it comes at the expense of Partial hedge rather than a complete hedge.

FxWirePro: Engulfing bear on GBP/JPY; add BPS on hedging front

Wednesday, July 8, 2015 6:03 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings