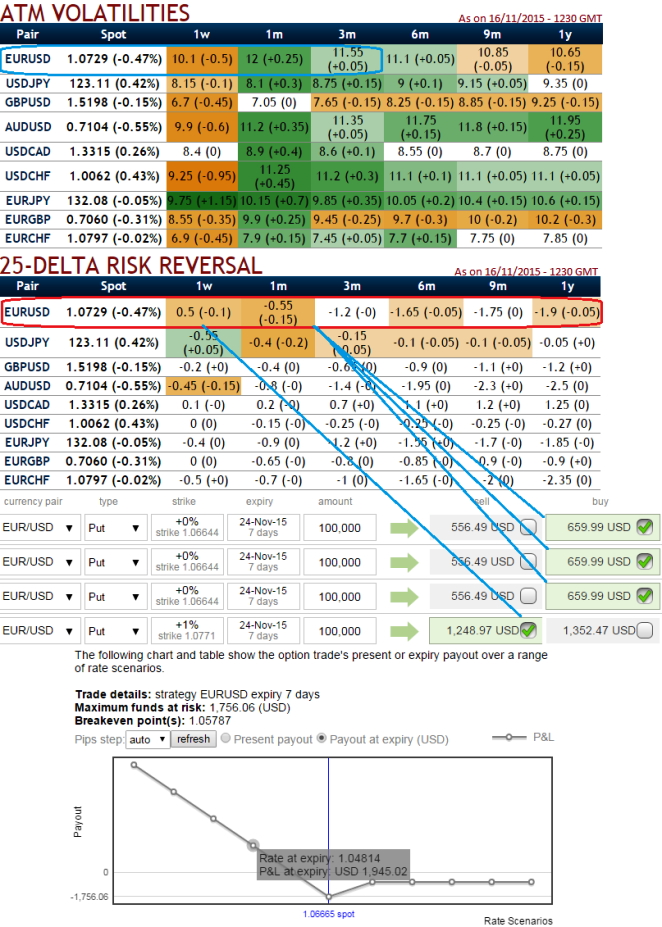

As you can observe from the diagram the implied volatility for near month at the money contract of this G7 major has been highest among currency pool, likely to perceive at 12% for 1m expiry.

While delta risk reversal reveals downside hedging activity has also been piling up gradually for next 1 month. As a result we can understand ATM puts have been costlier where the FX market direction of this is heading towards 1.0595 and 1.0505 technical levels. Currently, it is struggling at 1.0645 levels.

The OTC options market appeared to be more balanced on the direction for the pair over the 1y to 1m time horizon and as a result delta risk reversal for EURUSD has been maintaining negative which means puts are in higher demand and overpriced comparatively.

Hence, EURUSD's higher IV with negative delta risk reversal can be interpreted as the market reckons the price has downside potential for large movement ahead of FOMC season which is resulting derivatives instruments for downside risks have been overpriced and fresh shorts are more on the cards.

But any spikes in this pair in near term can be attributed as shorting opportunity in our back spreads. As shown in the diagram, contemplating the above risk reversal computations, we construct strategy comprising of both calls as well as puts in the ratio of 3:1 so as to suit the swings on either directions.

Capitalizing on higher IV and positive risk reversals in short run, we eye on shorting (1%) 1w in the money put which would lock in certain yields by initial receipts of premiums.

Thereafter, 3 lots of 1m ATM -0.50 delta puts are preferred to suit the prevailing losing streaks. So thereby the spread would be executed for net debit and the cost is reduced by short side.

FxWirePro: Employ EUR/USD diagonal backspreads on highest IV and risk reversal among G20 space

Tuesday, November 17, 2015 11:21 AM UTC

Editor's Picks

- Market Data

Most Popular

3