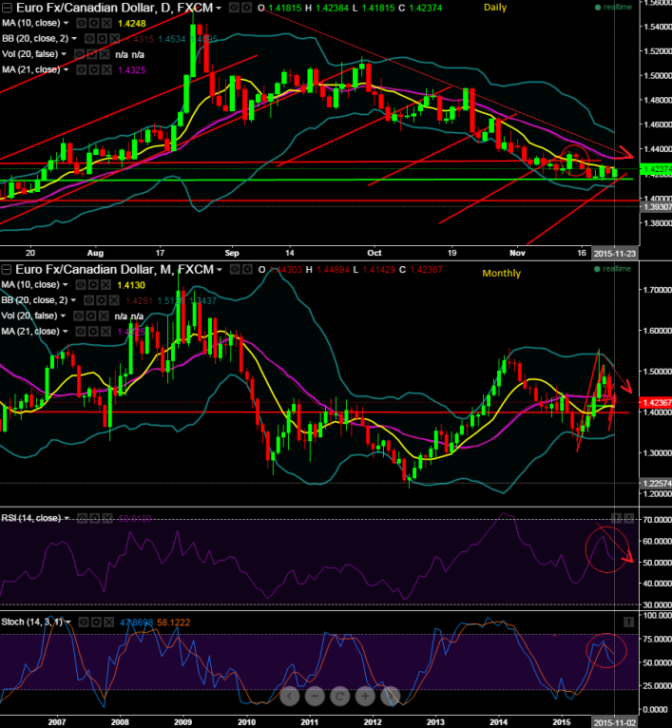

We had earlier also traced out bearish indications to head towards 1.4355 and even the levels up to 1.4150.

As both the weekly and monthly indications by leading oscillators are converging with ongoing dropping prices (see circled area), we foresee more weakness in the pair as a result a breach of trendline support at 1.4138 is most likely.

For now the pair is the most likely to retest 1.3992 contemplating significant support for bulls at these levels.

We believe if it holds these levels then healthy bounce back may happen otherwise the declines until 1.3979 in near term and 1.3537 in long term is also possible (i.e. previous channel distance).

If you predict Euro to spike up against Canadian dollar, then cover your underlying currency exposures with collars strategy.

This strategy is for those who have Euro exposure at present who are concerned about a correction and wish to hedge the long spot currency position. So, how do you do that? The hedger takes following positions to construct this strategy:

Write an OTM call option + hold an ITM put option (near month Call & mid month put).

This helps as a means to hedge a long position in the underlying outrights by holding longs on protective put.

Thereby, any declines in this pair would be taken care by ITM put options since the holder of the put option will have right to sell at predetermined strike price at expiry in case of European style options.

Maximum return = Strike price of call - Currency spot FX - net premium paid.

FxWirePro: Employ EUR/CAD collars as trendline support seems likely

Monday, November 23, 2015 8:36 AM UTC

Editor's Picks

- Market Data

Most Popular