The Chinese PMIs indicate easing Trend in Trade: China’s NBS manufacturing PMI eased in April, declining to 51.2 from 51.8 in March, which was the highest reading since April 2012. Easing was broad-based across the major components, including output, new orders, new export orders, and employment, while input prices declined further. Meanwhile, the Caixin manufacturing PMI marked a similar trend, easing to 50.3 in April, from 51.2 in March.

While China's trade surplus fell to USD 38.5 billion in April of 2017 from USD 39.16 billion surpluses a year earlier but above market consensus of a USD 35.50 billion surpluses, as exports rose less than imports. Year-on-year, sales grew by 8.0 pct to USD 180 billion, slowing from a 16.4 percent rise in the prior month while market expected a 10.4 pct gain.

Tightening Chinese interbank rates reinforce the soft-landing story.

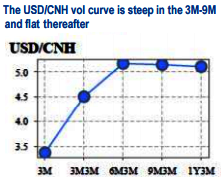

A steeply upward sloping CNH vol curve in the 3M-1Y segment motivates forward vol selling at a substantial premium to spot ATM vol. The steepness of the vol curve is substantial for the level of base vols (refer above chart) and worth milking via +2M/-9M gamma-neutral calendar spreads in the absence of a liquid forward volatility (FVA) product market.

The flatness of the CNH vol term structure beyond the 1Y point also motivates carry-earning calendar spreads, preferably in the direction of slow-burn currency weakness that is the baseline outcome in the minds of many investors.

For pure vol investors, delta-hedged -9M straddle vs. +18M 25d strangle calendars can exploit this flatness while alongside the cheapness of CNH flies (even adjusted for ATM vol levels) that increase the appeal of short straddle/long strangle packages.

For directional investors not given to frequent delta-hedging, we propose -9M 7.05 vs. +18M 7.15 USD call/CNH put calendars that accrues positively to the over the life of the short leg while awaiting a renewal of RMB weakness, possibly after the November plenum.

Long 3M EURCNH 25D risk-reversal, delta-hedged.

Buy an eq-weighted basket of EURSGD puts, EURCNH puts and EURINR puts, 2M 5% OTMS strikes, vs. sell 2M 5% OTMS EURAUD puts.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?