A trade on a buy-and-hold logic is designed in USDJPY. It shorts volatility but should suffer from initial negative convexity.

Selling the expensive volatility to trade a gradual move Uncertainty is not going to lift volatility until the environment turns risk-off. So far, the Trump victory has not triggered such a shift. On top of that, the USDJPY uptrend is likely to slow down after the initial topside acceleration in autumn 2016. As we suspected, the BoJ yield control transferred rates volatility towards FX volatility. But yen depreciation should now be more gradual.

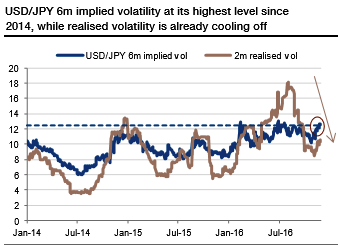

The recent fast upside lifted the 6m implied volatility to its highest level since 2014 (refer above graph). While the 2m realised volatility peaked at 18, it is already retracing much lower. With no risk-off shift in sight, and vega volatility still having to adjust to short-term dynamics, a short volatility structure makes sense.

We do not expect the USDJPY to exceed 126 (multiyear double top since 2002), we opt for a call spread ratio 1x1.5, such that the topside breakeven is at this level (see above graph).

Selling volatility means negative convexity, and investors would thus suffer in terms of mark-to-market if USDJPY gains were to accelerate early. We mitigate that risk by selecting a 6m expiry, which reduces the negative gamma compared to a shorter expiry and fits the idea of a gradual appreciation. However, lengthening the maturity would not by itself fully prevent the risks inherent to a short gamma profile.

So we pick sufficiently OTM strikes to protect the trade against a two-month move to 118 and a four-month to 122. These breakeven levels increase if the implied volatility falls.

All in all, the trade is profitable if the USD/JPY trades between 118 and 125 in six months and will generate a maximal leverage at the 120.5 strike.

Buy USDJPY 6m call spread 1x1.5 strikes 118/120.5 Zero cost (indicative, spot ref: 114.30) Trade risks: USDJPY above 125 in six months. USDJPY acceleration beyond 118 after the first two months would hurt the mark-to-market of the strategy. Investors face unlimited losses if the USDJPY trades above 125 at the 6m expiry.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes