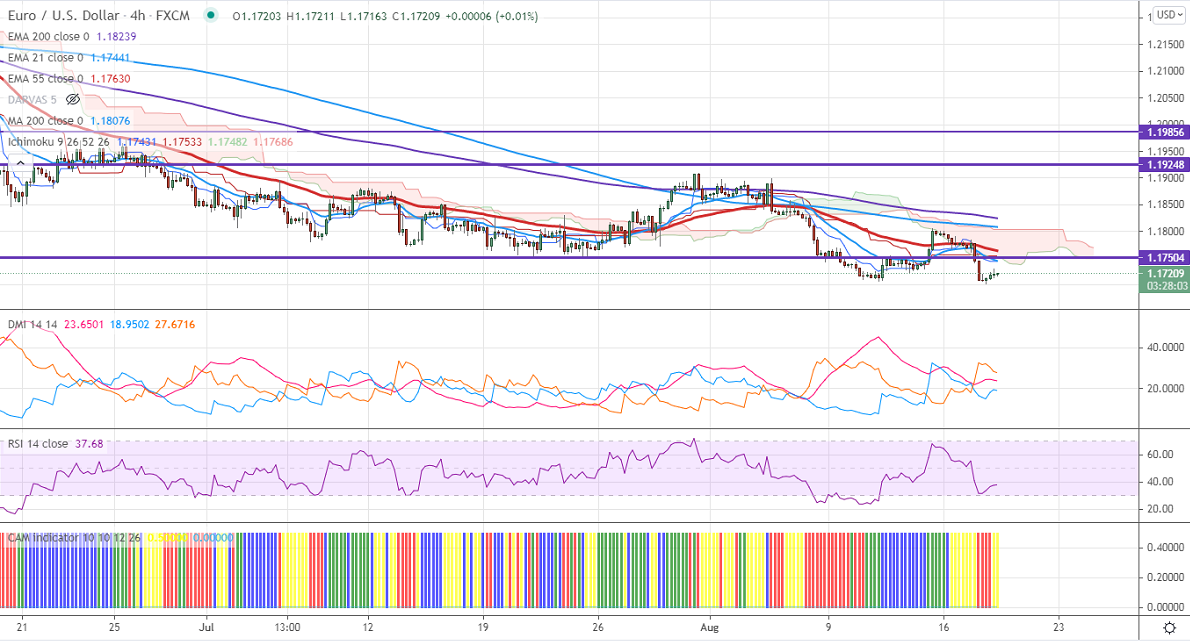

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.17431

Kijun-Sen- 1.17533

EURUSD has declined more than 80 pips after a minor pullback to 1.18048. The spread of delta variant coronavirus across the globe has increased the demand for safe-haven assets. The US retail sales have dropped by -1.1% in July much below the estimated -0.2%. Markets eye US Fed meeting minutes today for further direction. The pair hits an intraday low of 1.17294 and is currently trading around 1.17184.

Technical:

On the higher side, near-term resistance is around 1.1730 and any convincing breach above will take to the next level 1.1765/1.1800. The pair's near-term support is at 1.1700, break below targets 1.1660/1.1600.

Indicator (4-hour chart)

CAM indicator-Neutral

Directional movement index – Neutral

It is good to sell on rallies around 1.1758-60 with SL around 1.1800 for the TP of 1.1600.