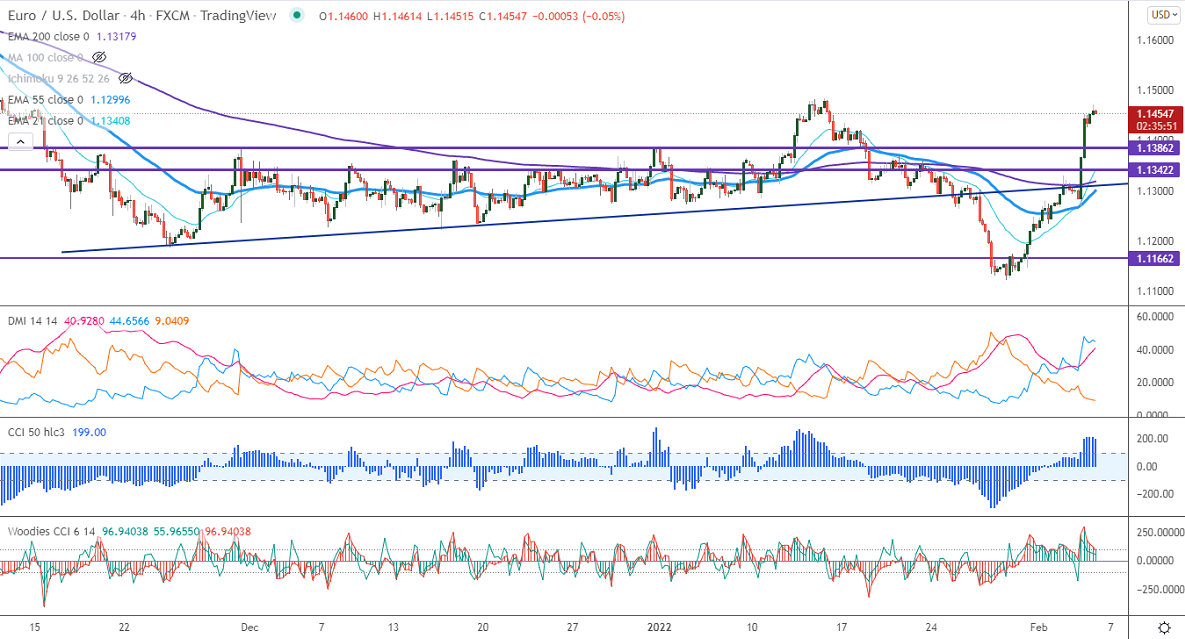

Intraday trend – Bullish

Major intraday Support– 1.1400

The pair recovered sharply and jumped more than 200 pips on European Central Bank monetary policy. It has kept its rates unchanged despite surging inflation. The central bank opened doors for faster monetary policy tightening. The German bund yield continues to trade higher for a third consecutive day on hawkish policy. Markets eye US Non-farm payroll data for further direction. It hits an intraday high of 1.14717 and is currently trading around 1.14554.

Technical-

Any breach below 1.1430 confirms intraday bearishness. A dip till 1.1380/1.130 is possible.

The immediate resistance to be watched is 1.1500; any violation above will take the pair to 1.1580/1.1700.

Indicators (4-hour)

Directional movement index –Bullish

CCI (50) – Bullish

It is good to buy on dips around 1.1400 with SL around 1.1348 for a TP of 1.1500.