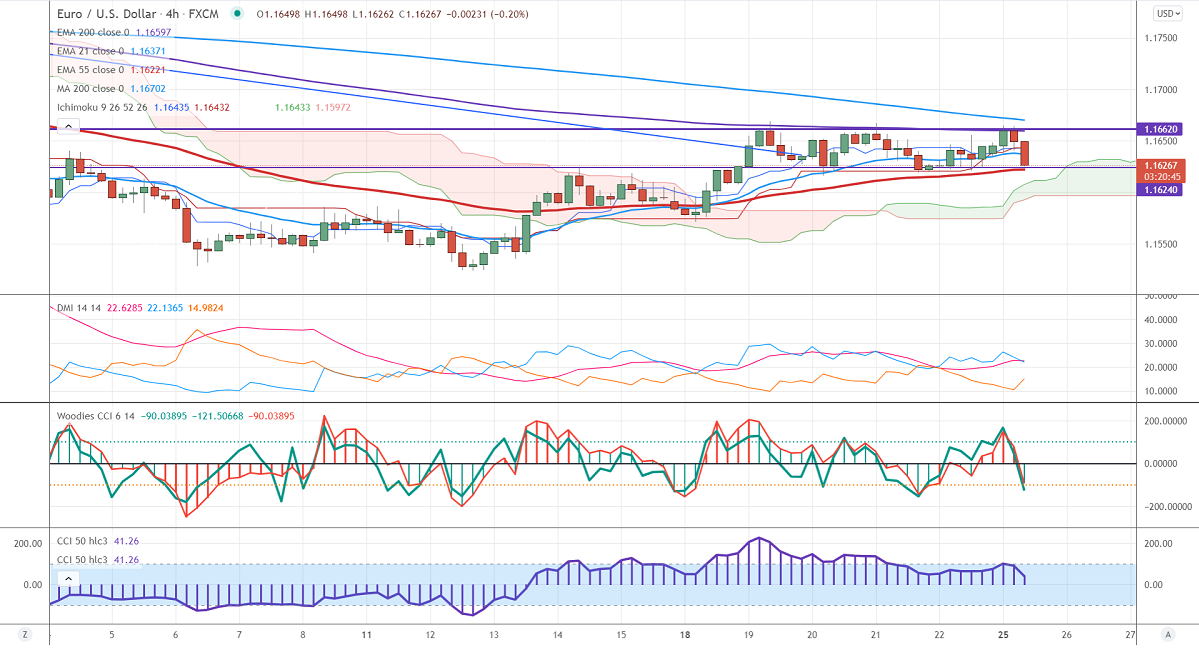

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.16427

Kijun-Sen- 1.16432

EURUSD has shown a minor sell-off after soft German IFO data. It declined to 97.70 in Oct compared to a forecast of 98.20. While IFO's current economic assessment rose to the 100.10 level. The US 10-year yield showed a minor weakness after Fed Chairman comments on Fed bond tapering and rate hike. He has said that the central bank will start bond tapering by this year. The inflation risks are temporary and will be back normal to the Fed's target of 2%. The pair surged till 1.16650 and is currently trading around 1.16301.

Technical:

On the higher side, near-term resistance is around 1.1670 and any convincing breach above will drag the pair to the next level 1.17010/1.1760. The pair's immediate support is at 1.1600, breaking below targets 1.1570/1.1525.

Indicator (4-hour chart)

Directional movement index – Neutral

It is good to sell on rallies around 1.1660-625 with SL around 1.17010 for a TP of 1.1525.