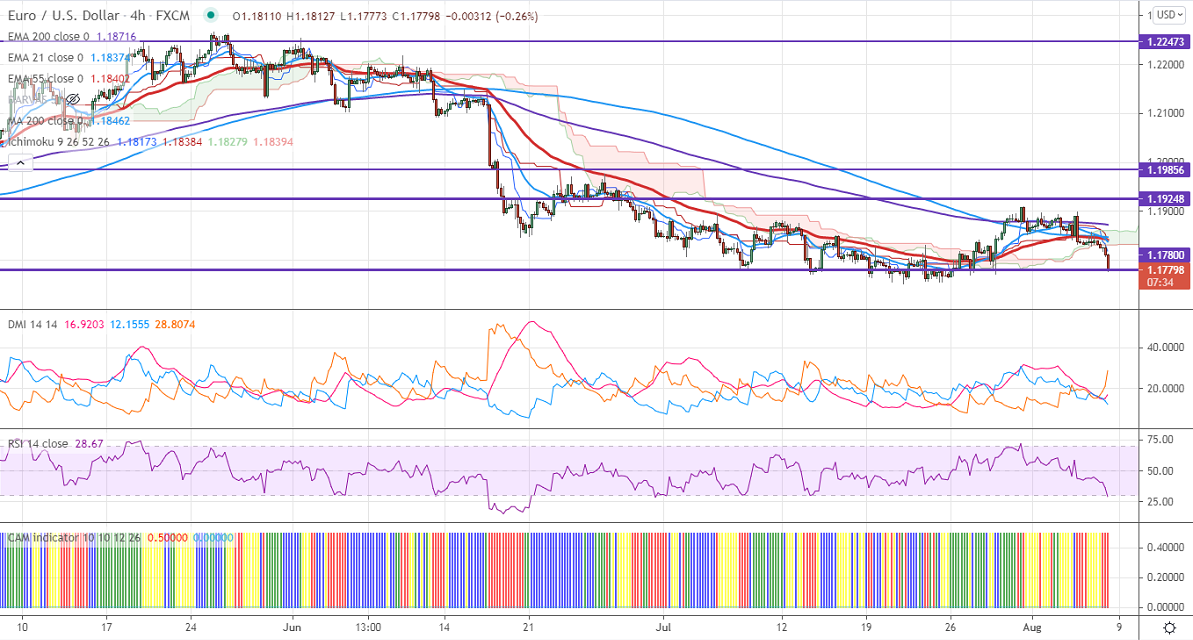

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.18170

Kijun-Sen- 1.18381

EURUSD declined sharply after upbeat US Non-farm payroll data. The US economy has added 943000 jobs in Jul compared to an estimated 870000. While unemployment came at 5.4% vs the forecast 5.7%.The average hourly earnings jumped to 0.4% above the forecast of 0.3%. The pair hits an intraday low of 1.17813 and is currently trading around 1.17901.

Technical:

On the higher side, near-term resistance is around 1.1830 and any convincing breach above will take to the next level 1.1865/1.1920. The pair's near-term support is at 1.1780, break below targets 1.1750/1.1700.

Indicator (4-hour chart)

CAM indicator-Bearish

Directional movement index – Bearish

It is good to sell on rallies around 1.1788-790 with SL around 1.1835 for the TP of 1.1700.