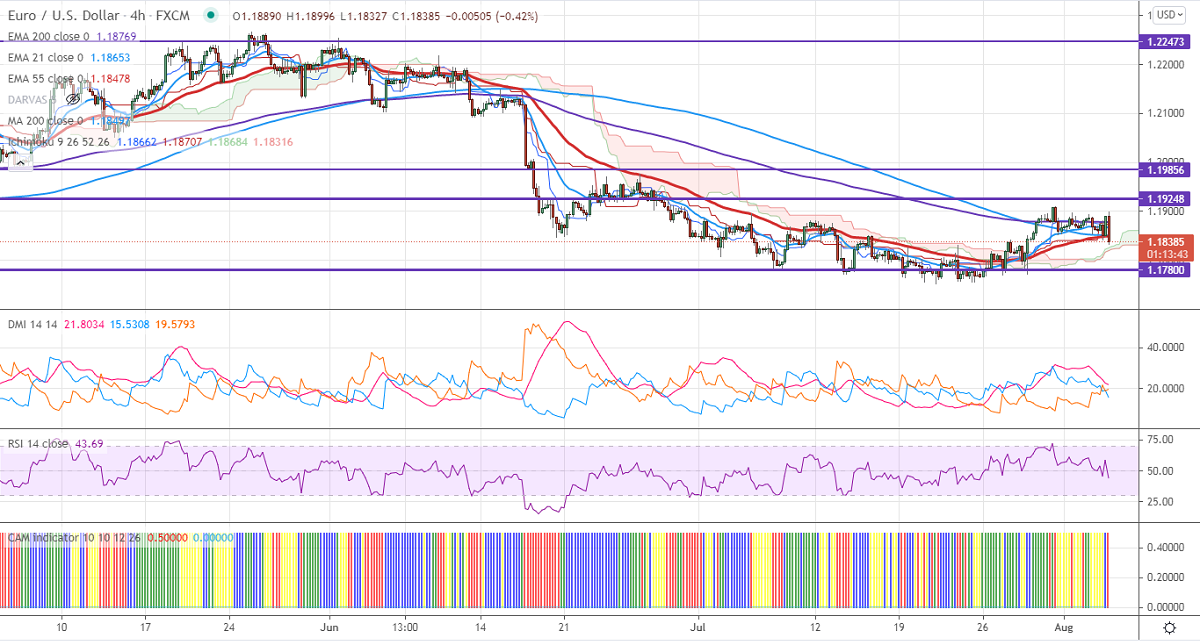

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.18677

Kijun-Sen- 1.18753

EURUSD has lost more than 50 pips on upbeat US SIM services data. It hits a record high in July at 64.1 compared to a forecast of 60.40. The US private sector has added 33000 jobs in July well below expectations of 695000. The pair hits an intraday low of 1.18327 and is currently trading around 1.18382.

Technical:

On the higher side, near-term resistance is around 1.1865 and any convincing breach above will take to the next level 1.1920/1.19655/1.200. The pair's near-term support is at 1.1830, break below targets 1.1780/1.1750.

Indicator (4-hour chart)

CAM indicator-Neutral

Directional movement index – Neutral

It is good to sell on rallies around 1.1868-70 with SL around 1.1920 for the TP of 1.1700.