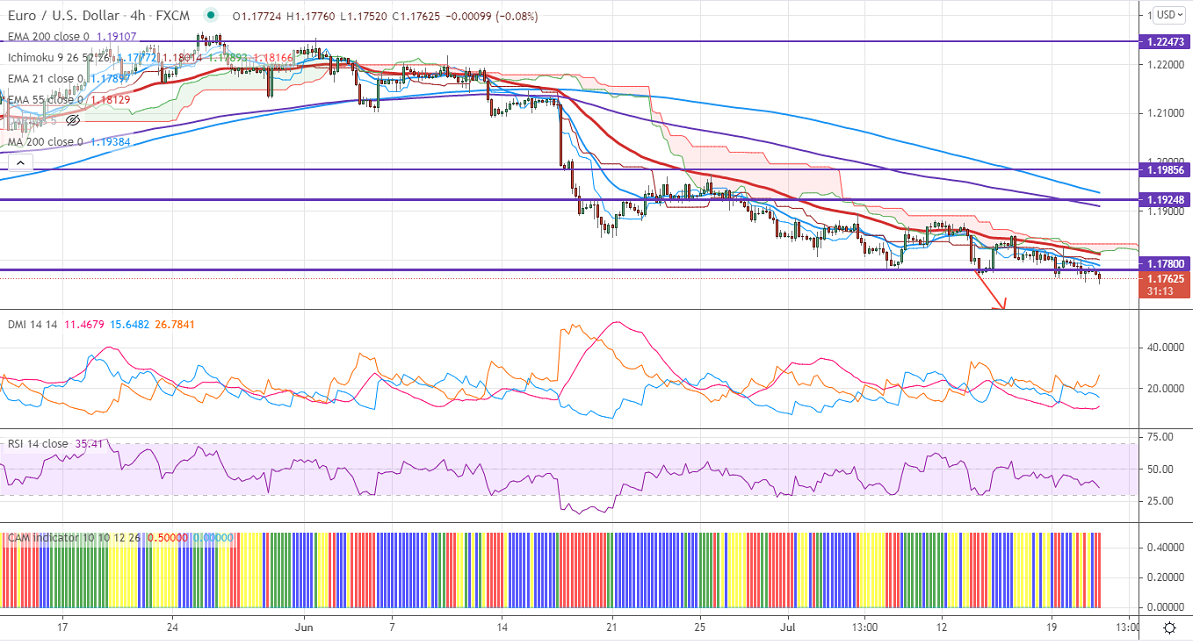

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.17990

Kijun-Sen- 1.18032

EURUSD hits three month low on board-based US dollar buying. The spread of delta variant coronavirus cases and hopes of dovish ECB is putting pressure on this pair. The average number of people who have been hospitalized in the US rose by 21% in the past 30 days. The pair hits an intraday low of 1.17520 and is currently trading around 1.17630.

Technical:

On the higher side, near-term resistance is around 1.1805 and any convincing breach above will take to the next level 1.1830/1.1880/1.19070/1.19655/1.200. The pair's near-term support is at 1.1750, break below targets 1.1700/1.1660.

Indicator (4-hour chart)

CAM indicator-Bearish

Directional movement index – Bearish

It is good to sell on rallies around 1.1780 with SL around 1.1830 for the TP of 1.1660.