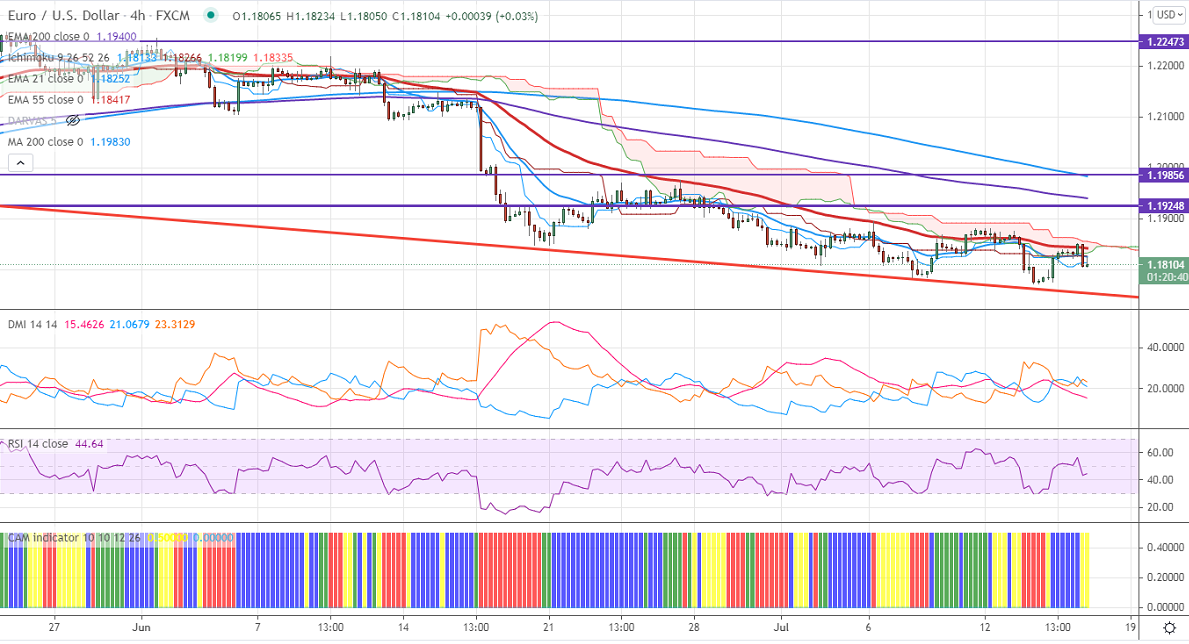

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.18133

Kijun-Sen- 1.18266

EURUSD lost more than 50 pips from intraday high 1.18507 as US dollar regains. The greenback surged on demand for safe-haven assets increases. US COVID -19 cases more than doubled in the last two weeks. The pair hits an intraday low of 1.18027 and is currently trading around 1.18140.

US weekly jobless claims came at 360k v.s 350k expected. The Philly Fed manufacturing index declined to 21.9 compared to an estimate of 28.

Technical:

On the higher side, near-term resistance is around 1.1860 and any convincing breach above will take to the next level 1.19070/1.19655/1.200. The pair's near-term support is at 1.17800, break below targets 1.17150.

Indicator (4-hour chart)

CAM indicator-Neutral

Directional movement index – Neutral

It is good to sell on rallies around 1.1838-40 with SL around 1.1870 for the TP of 1.1760/1.1715.