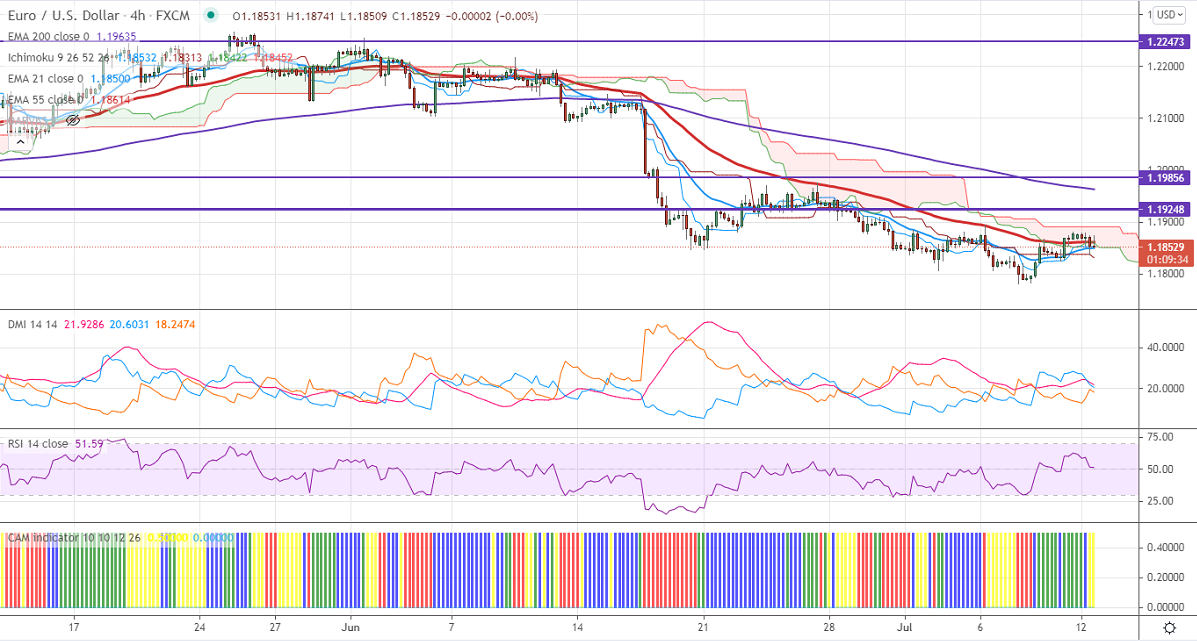

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 1.18532

Kijun-Sen- 1.18382

EURUSD is trading in a narrow range between 1.17813 and 1.18950 for the past four days. The dovish comments from ECB chairman Lagarde and spread of delta variant in major countries like the United kingdom etc. Markets eye US CPI data tomorrow for further direction. The US 10-year bond yield surged more than 10% from 4-1/2 month low 1.25%. EURUSD hits an intraday high of 1.18798 and is currently trading around 1.18556.

Technical:

On the higher side, near-term resistance is around 1.9070 and any convincing breach above will take to the next level 1.19655/1.200. The pair's near-term support is at 1.1830, break below targets 1.1780.

Indicator (4-hour chart)

CAM indicator-Neutral

Directional movement index – Neutral

It is good to sell on rallies around 1.1878-80 with SL around 1.19070 for the TP of 1.1780.