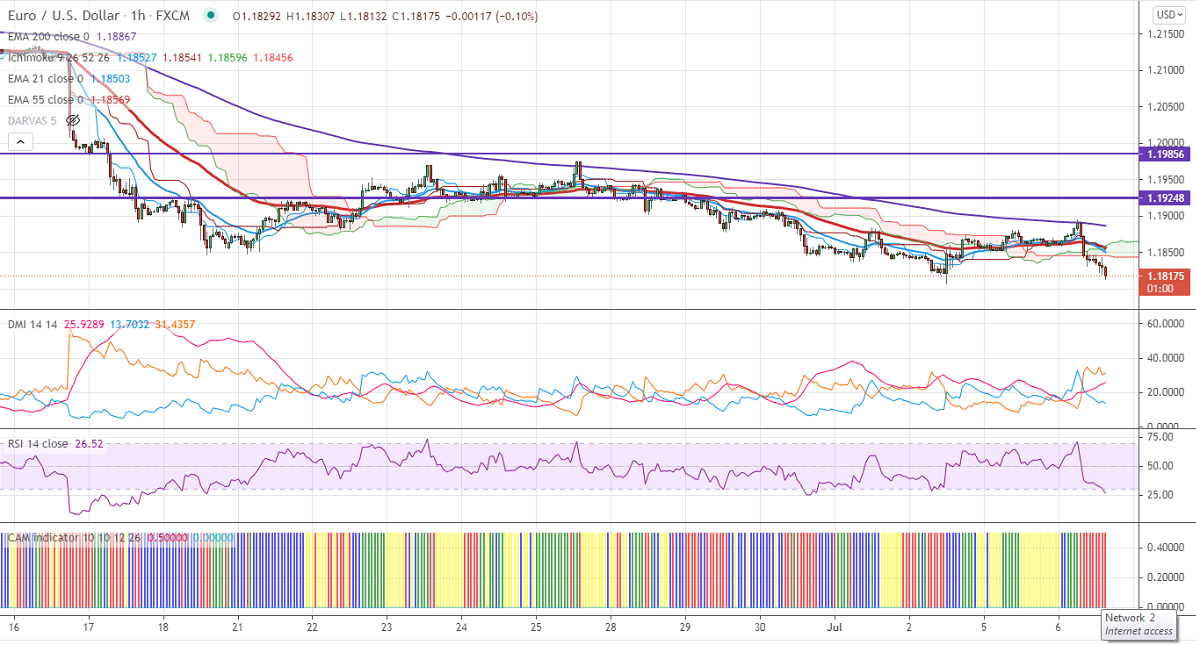

Ichimoku analysis (1-Hour chart)

Tenken-Sen- 1.18578

Kijun-Sen- 1.18578

EURUSD is trading weak despite weak US ISM services PMI data. The services PMI contracted to 60.1 in June compared to a forecast of 63.40. The German ZEW economic sentiment declined to 61.20 much below the estimate 75. The US 10-year yield has shown a massive sell-off of more than 4% and hits two weeks low. DXY is holding above 92.50 levels, any convincing surge above 92.75 confirms further bullishness. The pair hits an intraday low of 1.18157 and is currently trading around 1.18166.

Technical:

On the higher side, near-term resistance is around 1.18600, and any convincing breach above will take to the next level 1.19087/1.1945/1.200. The pair's near-term support is at 1.1800, break below targets 1.1760/1.1720.

Indicator (1-hour chart)

CAM indicator-Bearish

Directional movement index – bearish

It is good to sell on rallies around 1.18580-60 with SL around 1.19070 for the TP of 1.1760